Loading

Get P - 521 Request For Copies Of Tax Returns Or Forms W-2 - June 2012 - Revenue Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P - 521 Request For Copies Of Tax Returns Or Forms W-2 - June 2012 - Revenue Wi online

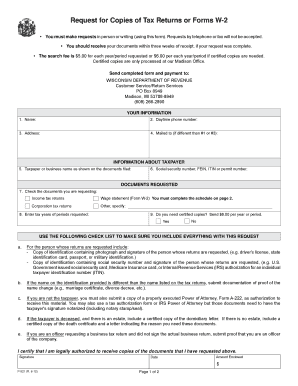

Filling out the P - 521 request form is a critical step for users seeking copies of their tax documents or Forms W-2. This guide provides clear instructions to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the request form.

- Press the ‘Get Form’ button to access the P - 521 document and open it in your preferred online platform.

- In the 'Your Information' section, fill in the following fields: your name, daytime phone number, address, and destination address if it differs from your address.

- Move to the 'Information About Taxpayer' section. Input the taxpayer's or business's name as indicated on the filed documents, along with the appropriate social security number, FEIN, ITIN, or permit number.

- In the 'Documents Requested' section, indicate which documents you are requesting by checking the appropriate boxes for income tax returns, wage statements (Form W-2), corporation tax returns, or any other documents needed.

- Specify the tax years or periods for the documents requested in the subsequent field.

- Indicate whether you require certified copies by selecting 'Yes' or 'No.' Remember, certified copies incur an additional fee.

- Review the checklist to ensure you include all necessary identification and documentation. This may include copies of identification and proof of any name changes if applicable.

- If you are not the taxpayer, include a properly executed Power of Attorney or relevant documents authorizing you to receive the requested information.

- If the taxpayer is deceased, attach the required documentation concerning the estate or a certified copy of the death certificate.

- Affirm that you are legally authorized to receive the documents by signing and dating the form.

- Calculate the total amount enclosed for any fees related to your request and clearly write it in the designated field.

- Once completed, you can save your changes, download, print, or share the form as needed.

Take the next step and fill out your request form online today to obtain your tax documents!

To get your previous tax documents, visit the IRS website and utilize the Get Transcript service. Alternatively, you can file Form 4506 to request copies directly from the IRS. This process is straightforward and focuses on providing you the necessary documentation, including elements tied to the P - 521 Request For Copies Of Tax Returns Or Forms W-2 - June 2012 - Revenue Wi.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.