Loading

Get Form 880

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8880 online

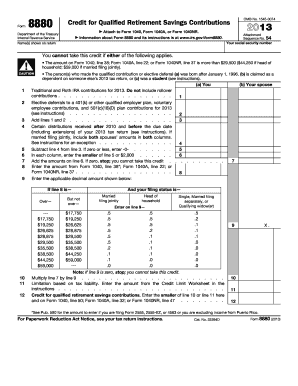

Filing your taxes can be a complex process, but understanding how to fill out Form 8880 can help you maximize your retirement savings contributions credit. This guide provides clear, step-by-step instructions for completing the form online.

Follow the steps to successfully complete Form 8880.

- Press the ‘Get Form’ button to acquire the form and access it on your device.

- In the first section, input the names shown on your tax return accurately. Ensure that both your and your spouse’s names are correctly entered if filing jointly.

- Enter your Social Security number in the designated field to ensure proper identification.

- Review the eligibility criteria for the credit. Make sure you qualify based on your income level and the status of contributions made during the tax year. If you do not meet the requirements, you will need to stop here.

- Input the amounts for traditional and Roth IRA contributions in the appropriate fields, excluding rollover contributions.

- Enter the amounts of elective deferrals to a qualified employer plan or voluntary employee contributions. Add these contributions in the subsequent fields as instructed.

- Complete the calculations as instructed, making sure to subtract fields as necessary and follow the guidelines provided for each line.

- If applicable, repeat the above steps for your spouse’s contributions if filing jointly.

- After completing all required fields, review your answers for accuracy. Make sure all totals are correctly calculated.

- Finally, save your changes, download the completed form, print it for your records or share it as necessary.

Take action now and file your Form 8880 online to ensure you receive your eligible retirement savings contributions credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When filling out form 880, you should include your qualifying retirement contributions, your income details, and a few personal identification details. It is essential to provide accurate information to ensure your credit calculation is correct. Using an intuitive platform like USLegalForms can make the process smoother.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.