Get Form 8752

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8752 online

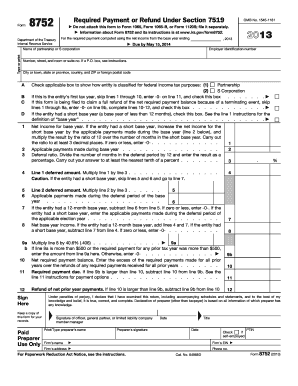

This guide provides a clear and comprehensive overview of how to complete Form 8752 online. Designed for partnerships and S corporations, this form is essential for reporting required payments or refunds under section 7519. Whether you are new to tax forms or have some experience, this step-by-step approach will help you complete the process with confidence.

Follow the steps to successfully fill out Form 8752 online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering the name of the partnership or S corporation. Ensure that you type or print this information clearly.

- Input the employer identification number in the designated field.

- Fill in the complete address of the partnership or S corporation, including any suite or room numbers as required.

- Select the applicable box to indicate the tax classification of the entity, whether it is a partnership or S corporation.

- If this is the entity’s first tax year, make sure to check the appropriate box and enter -0- on line 11.

- For entities filing to claim a full refund due to a terminating event, skip lines 1-9a, enter -0- on line 9b, and fill in lines 10-12.

- Proceed to calculate the net income for the base year, ensuring to carry out the calculations accurately.

- Carefully fill in the applicable payments made during the base year.

- Determine the deferral ratio as instructed and enter the result as a percentage.

- Complete subsequent calculations based on the previous lines to determine required payments or refunds as specified.

- Once completed, save your changes, and download or print the form as necessary. Ensure to keep a copy for your records before submission.

Take action today and complete your Form 8752 online to ensure timely filing and compliance.

Form 8582 is the IRS tax form used to report passive activity losses and credits. It provides a structured way to track how much passive loss you can deduct based on income from passive activities. Filing this form accurately is vital in managing your tax responsibilities effectively. For assistance with Form 8582, consider the resources available at uslegalforms, which can greatly simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.