Loading

Get Hsa Deferral Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hsa Deferral Form online

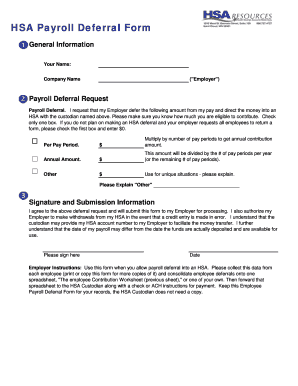

The Hsa Deferral Form is an important document for employees wishing to defer a portion of their pay into a Health Savings Account (HSA). This guide provides comprehensive, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to successfully complete the Hsa Deferral Form online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering your name and the name of your employer in the designated fields. Ensure that the information is accurate to avoid processing delays.

- In the 'Payroll Deferral Request' section, specify the amount you wish to defer from your pay per pay period. If you do not plan to make a deferral, check the first box and enter '0'.

- Calculate your annual contribution amount by multiplying your per pay period deferral by the number of pay periods in a year. Enter this total in the 'Annual Amount' field.

- If applicable, use the 'Other' field to specify any unique situations regarding your deferral. Be sure to provide a brief explanation as requested.

- At the bottom of the form, review the statement regarding your agreement to the deferral request and the authorization for your employer to make necessary withdrawals. Sign the form in the designated area and enter the date.

- Once all fields are completed, save your changes. You may also choose to download, print, or share the form as needed for your records.

Complete your Hsa Deferral Form online today to take control of your health savings.

The IRS form for addressing excess HSA contributions is Form 5329. If you inadvertently contribute more than the allowable limit, filing this form is critical to avoid penalties. We recommend utilizing resources, such as our USLegalForms platform, to find guidance on how to manage your HSA contributions properly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.