Get Claim For Drawback Of Tax On Tobacco Products, Cigarette Papers, And Cigarette Tubes - Ttb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CLAIM FOR DRAWBACK OF TAX ON TOBACCO PRODUCTS, CIGARETTE PAPERS, AND CIGARETTE TUBES - Ttb online

Filing a claim for drawback of tax on tobacco products can seem daunting, but this guide will walk you through each step of the CLAIM FOR DRAWBACK OF TAX ON TOBACCO PRODUCTS, CIGARETTE PAPERS, AND CIGARETTE TUBES - Ttb form. By following these clear instructions, you will be able to complete the form accurately and effectively.

Follow the steps to successfully fill out your claim.

- Click ‘Get Form’ button to access the form and open it in the online editor.

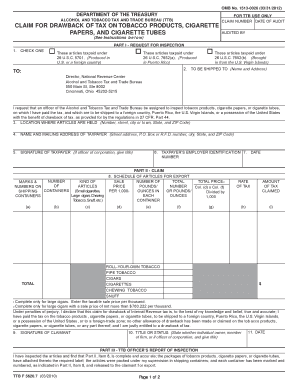

- In Part I, check the appropriate box for the type of tax paid on the articles. Specify whether they were produced in the U.S., Puerto Rico, or brought in from the U.S. Virgin Islands.

- Provide the shipping destination by entering the name and full address of where the items will be shipped.

- Enter the location where the articles are currently held; include the complete address with street, city, state, and ZIP code.

- Fill out the taxpayer's information. Include the name, mailing address, and if applicable, the title of the taxpayer.

- List the kind and number of articles in the shipping containers in the designated fields. Include details like size and type, ensuring all shipping container information is accurate.

- Enter the taxpayer's employer identification number to complete your identification.

- In Part II, fill out the schedule of articles for export. For each type of tobacco product, record the total price, weight, rate of tax, and amount of tax claimed.

- Complete the declaration at the bottom of Part II. This confirms the accuracy of your claim under penalties of perjury.

- Have the claimant sign and date the form, indicating their title or status.

- If required, make sure a TTB officer inspects the articles, and complete Part III of the form with the inspector's report.

- Proceed to the Customs Certificate sections in Part IV and complete as instructed, ensuring all necessary details are provided if using a foreign-trade zone or postal service.

- Finally, after reviewing all parts of the form for completeness, save any changes made, and proceed to download, print, or share the form as necessary.

Complete your CLAIM FOR DRAWBACK OF TAX ON TOBACCO PRODUCTS online today for an efficient filing experience.

Higher taxes on tobacco companies can substantially reduce the overall supply of cigarettes in the market. Manufacturers often respond to increased tax burdens by scaling down production or raising prices to maintain profit margins. This dynamic can lead to increased competition among remaining suppliers and a rising interest in exploring a CLAIM FOR DRAWBACK OF TAX ON TOBACCO PRODUCTS, CIGARETTE PAPERS, AND CIGARETTE TUBES - Ttb. Ultimately, these changes impact consumers by providing fewer options and higher prices.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.