Loading

Get Form 4136

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4136 online

Filling out the Form 4136 online can be straightforward if you follow the correct steps. This guide aims to provide you with a clear, step-by-step approach to ensure accurate completion of this tax document.

Follow the steps to fill out the Form 4136 successfully.

- Press the ‘Get Form’ button to access the form in your browser.

- Begin by entering your taxpayer identification number in the designated field, ensuring it matches what is shown on your tax return.

- Fill in your name as it appears on your income tax return in the provided section.

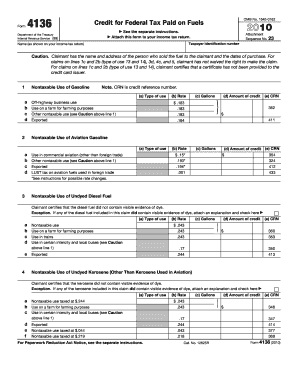

- Review the cautionary notes regarding claims and ensure you understand the necessary certifications related to the fuel purchases.

- For section 1, select the type of nontaxable use of gasoline and input the relevant rates, gallons, and amounts of credit.

- Continue to section 2, where you will similarly input the data for nontaxable use of aviation gasoline, ensuring accuracy for rates and amounts.

- In sections 3 through 8, move through the forms, denoting the respective rates, gallons used, and amount of credit for undyed diesel fuel and kerosene as well as their specific uses.

- For sections 9 and 10, record information regarding alcohol fuel mixtures and biodiesel mixtures, along with the corresponding amounts.

- Complete the remaining sections for alternative fuel and various credit scenarios, filling out each type of use, rate, gallons, and the amount of credit.

- Once all fields are filled, carefully review the form for any errors or omissions. You can then save your changes, and opt to download, print, or share the form as necessary.

Start completing your Form 4136 online today to ensure you maximize your tax credits.

Common tax mistakes include incorrect reporting of income, failing to claim eligible deductions and credits, and not utilizing Form 4136 for available fuel tax credits. Many individuals overlook opportunities to claim refunds, simply due to lack of knowledge. Staying organized and informed, along with using tools from uslegalforms, can help you avoid these pitfalls and ensure that your tax return is correct and complete.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.