Get Mutual Of Omaha Term Life Portability Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mutual Of Omaha Term Life Portability Request Form online

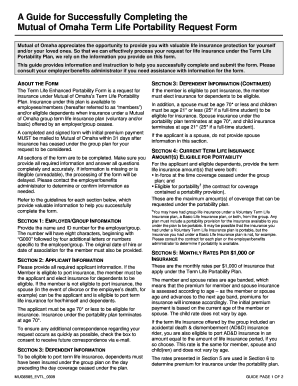

Completing the Mutual Of Omaha Term Life Portability Request Form online is an important step to securing your life insurance coverage after your group plan ends. This guide provides clear instructions to help you navigate each section of the form with confidence.

Follow the steps to successfully complete your portability request

- Click ‘Get Form’ button to obtain the form and open it in the editing platform.

- Fill out Section 1: Employer/Group Information. Provide your employer's name, Group ID number (which starts with 'G000' followed by four characters), and the date of hire or association.

- Complete Section 2: Applicant Information. Enter your last name, first name, address, email, city, state, zip code, birth date, telephone number, social security number, and select consent for e-mail correspondence if preferred. Specify the applicant type and reason for request.

- In Section 3: Dependent Information, provide information about your dependents, including their names, genders, and birthdates. Only include dependents if applicable.

- Proceed to Section 4: Current Term Life Insurance Amount(s) Eligible for Portability. Enter the eligible insurance amounts for yourself and any dependents, ensuring they match the amounts that were in force when your group coverage ceased.

- Go to Section 5: Monthly Rates Per $1,000 of Insurance. Familiarize yourself with the rates based on age, which will determine the premium costs.

- In Section 6: Portability Insurance Election & Initial Premium Payment Calculation, select the type of insurance, provide the requested insurance amounts, and calculate the monthly premium as guided in the section. Ensure all calculations are completed for accuracy.

- Designate your beneficiaries in Section 7: Beneficiary for Death Benefits. Provide the names, relationship, and address of your chosen beneficiaries.

- Read and acknowledge the statements in Section 8: Acknowledgement and Signature. Sign and date the form to confirm your agreement.

- Lastly, mail the completed form and initial premium payment, ensuring it is sent to Mutual of Omaha within 31 days of coverage cessation. The payment must include the Group ID Number.

Complete your Mutual Of Omaha Term Life Portability Request Form online today to secure your insurance coverage.

Like many large corporations, Mutual of Omaha has faced various lawsuits over the years, typically related to policyholder disputes or business practices. However, the company works diligently to resolve these issues and maintain a positive relationship with its clients. If you have concerns or questions regarding your policy or the Mutual Of Omaha Term Life Portability Request Form, consider seeking legal advice or contacting the company directly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.