Get Arizona Form A4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

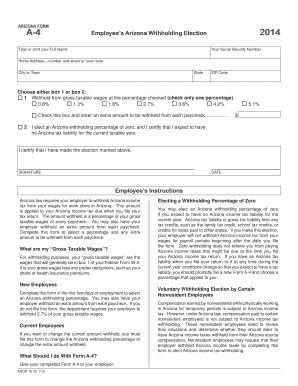

Tips on how to fill out, edit and sign Arizona Form A4 online

How to fill out and sign Arizona Form A4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Business, legal, tax along with other e-documents require an advanced level of compliance with the law and protection. Our documents are updated on a regular basis in accordance with the latest legislative changes. Additionally, with our service, all the information you provide in your Arizona Form A4 is well-protected against loss or damage with the help of cutting-edge encryption.

The tips below can help you fill out Arizona Form A4 easily and quickly:

- Open the document in the feature-rich online editor by clicking on Get form.

- Fill out the necessary fields which are colored in yellow.

- Press the green arrow with the inscription Next to jump from box to box.

- Go to the e-signature tool to add an electronic signature to the template.

- Insert the date.

- Double-check the entire document to make sure you haven?t skipped anything.

- Hit Done and download the resulting document.

Our platform allows you to take the entire process of completing legal documents online. Due to this, you save hours (if not days or weeks) and get rid of additional expenses. From now on, complete Arizona Form A4 from home, office, as well as while on the go.

How to edit Arizona Form A4: customize forms online

Use our comprehensive editor to transform a simple online template into a completed document. Keep reading to learn how to modify Arizona Form A4 online easily.

Once you find an ideal Arizona Form A4, all you have to do is adjust the template to your needs or legal requirements. In addition to completing the fillable form with accurate details, you might need to delete some provisions in the document that are irrelevant to your circumstance. On the other hand, you may want to add some missing conditions in the original template. Our advanced document editing features are the simplest way to fix and adjust the form.

The editor allows you to modify the content of any form, even if the file is in PDF format. You can add and remove text, insert fillable fields, and make extra changes while keeping the initial formatting of the document. You can also rearrange the structure of the document by changing page order.

You don’t have to print the Arizona Form A4 to sign it. The editor comes along with electronic signature capabilities. Most of the forms already have signature fields. So, you just need to add your signature and request one from the other signing party with a few clicks.

Follow this step-by-step guide to make your Arizona Form A4:

- Open the preferred template.

- Use the toolbar to adjust the form to your preferences.

- Fill out the form providing accurate information.

- Click on the signature field and add your eSignature.

- Send the document for signature to other signers if needed.

After all parties complete the document, you will get a signed copy which you can download, print, and share with others.

Our services allow you to save tons of your time and minimize the risk of an error in your documents. Improve your document workflows with effective editing capabilities and a powerful eSignature solution.

Single: W-4 Single status should be used if you are not married and have no dependents. Married: W-4 married status should be used if you are married and are filing jointly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.