Get Arizona Form A4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Form A4 online

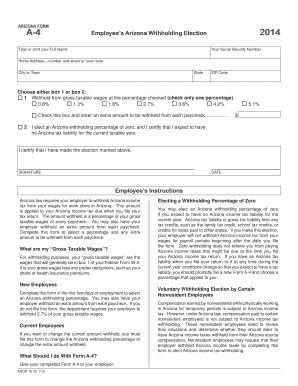

Navigating tax forms can be challenging, but filling out the Arizona Form A4 online doesn't have to be. This guide provides step-by-step instructions to help you complete the Employee’s Arizona Withholding Election form accurately and efficiently, ensuring your tax withholding aligns with your financial situation.

Follow the steps to complete the Arizona Form A4 online

- Press the 'Get Form' button to obtain the Arizona Form A4 and open it in your preferred editing tool.

- Begin by entering your full name in the designated field at the top of the form.

- Next, provide your Social Security Number to identify your tax records correctly.

- Fill in your home address, including the number and street or rural route, followed by the city or town, state, and ZIP code.

- Choose one of the two options for withholding: Box 1 if you wish to withhold a percentage from your wages or Box 2 if you do not expect any Arizona tax liability for the current year.

- If opting for Box 1, check only one box corresponding to the percentage you would like withheld (ranging from 0.8% to 4.2%) or enter a specific extra amount you want withheld in the available field.

- If opting for Box 2, ensure that you indicate your understanding of having no Arizona tax liability and proceed to certify your election.

- Sign and date the form to validate your election and ensure it is processed correctly.

- Finally, save your changes, then download, print, or share the form with your employer as required.

Complete your Arizona Form A4 online today to ensure the correct withholding from your paychecks.

The Arizona A4 form is a document that helps employees communicate their desired tax withholding amounts to their employers. By completing the form, you declare your filing status and any allowances, which ultimately impacts how much tax gets withheld from your paycheck. Using the Arizona Form A4 accurately can help manage your tax liabilities effectively throughout the year.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.