Loading

Get Form12 Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form12 Revenue online

Filling out the Form12 Revenue online can seem daunting, but this guide will simplify the process for you. By following the steps outlined here, you will be able to complete the form efficiently and accurately, ensuring that all necessary information is provided.

Follow the steps to complete the Form12 Revenue online.

- Click 'Get Form' button to obtain the form and open it in the editor.

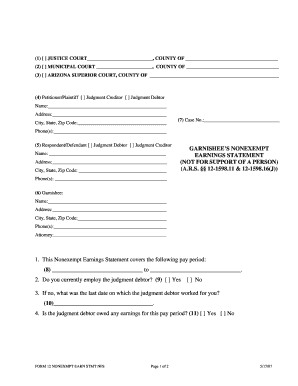

- Begin by filling in the court name and county at the top of the form. Indicate whether you are the petitioner, plaintiff, judgment creditor, or judgment debtor by selecting the appropriate option.

- Provide your name, address, city, state, and zip code. Make sure to include your phone number for contact purposes.

- Next, complete the respondent or defendant section by filling in their name, address, and contact information, similarly to how you completed your own details.

- In the garnishee's nonexempt earnings statement section, fill in the garnishee's name, address, and phone number. If applicable, include the attorney's information as well.

- Indicate the pay period covered by the nonexempt earnings statement by filling in the relevant dates.

- Answer the question regarding whether you currently employ the judgment debtor by selecting 'Yes' or 'No.' If 'No', provide the last date the judgment debtor worked.

- Indicate if the judgment debtor is owed any earnings for the specified pay period by selecting 'Yes' or 'No.'

- Proceed to fill in the judgment debtor's gross earnings for the pay period. Include deductions required by law to calculate disposable earnings.

- Select the judgment debtor's pay period frequency (weekly, biweekly, semimonthly, or monthly) and enter the current federal minimum wage.

- Use the provided lines to calculate the amount to withhold based on previous entries and deductions for any court-ordered assignments or other garnishments.

- After entering all required information, review the entire form to ensure accuracy, then save changes, download, print, or share the form as needed.

Complete your documents online today for a smoother filing experience.

You can typically download your tax form from your accounting software or financial management platform. If you are using Form12 Revenue, it provides an easy interface for accessing necessary tax forms. Ensure you select the correct form type related to your revenue transactions and follow the steps for downloading. Keeping your documentation up to date is essential for smooth tax filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.