Loading

Get Form Qba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Qba online

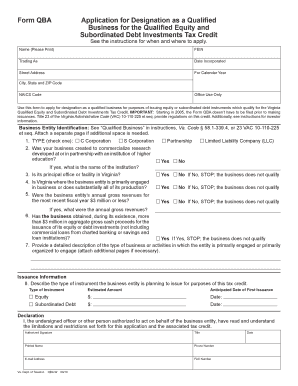

Form Qba is an essential application used to designate a qualified business for the Qualified Equity and Subordinated Debt Investments Tax Credit. This guide provides step-by-step instructions to help users successfully navigate and complete the form online.

Follow the steps to complete your Form Qba successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name of the business in the 'Name' field. Ensure that you print the name clearly for legibility.

- Enter the Federal Employer Identification Number (FEIN) in the appropriate field. This is a unique nine-digit number assigned by the IRS.

- Provide the 'Trading As' name if applicable. This is the business name under which the qualified business operates.

- Input the date of incorporation, indicating when the business was officially registered.

- Complete the 'Street Address,' followed by the 'City, State, and ZIP Code' fields to specify the business location.

- Indicate the calendar year for which you are applying for the tax credit.

- Provide the NAICS Code, which is a classification code that represents the business's industry.

- Choose the type of business entity by checking the appropriate box (C Corporation, S Corporation, Partnership, or Limited Liability Company).

- Answer questions 2 through 5 about the business's relationship with higher education institutions, location of operations, and revenue to determine if the business qualifies.

- In question 6, provide a description of the business activities if more space is needed—attach additional pages as necessary.

- For question 8, describe the type of financial instrument the business plans to issue, including the estimated amount and anticipated date of first issuance.

- Sign the declaration section, providing the authorized signature, title, printed name, contact number, and email address.

- Review all the information for accuracy before completing your submission.

- After finalizing the form, you may download, print, or share it as needed.

Complete the Form Qba online today for your business to gain access to significant tax credits.

Requirements for a Qualified Business Agent often include a solid understanding of tax implications, business regulations, and relevant professional experience. Meeting state mandates for business practices is also essential. To ensure you meet all necessary criteria, reviewing resources available on the US Legal Forms platform can be beneficial, especially when working with Form Qba.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.