Loading

Get Tiaa Cref Beneficiary Designation Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tiaa Cref Beneficiary Designation Forms online

Filling out the Tiaa Cref Beneficiary Designation Forms online is an essential process for ensuring your assets are distributed according to your wishes. This guide provides step-by-step instructions to help you navigate each section of the form with ease.

Follow the steps to complete your designation form successfully.

- Click ‘Get Form’ button to acquire the necessary form and open it in your preferred editing tool.

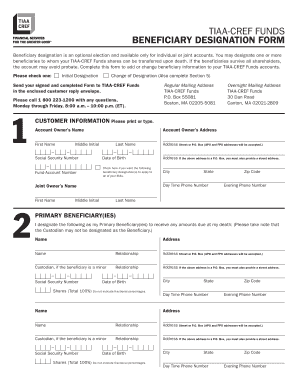

- Begin by entering your account owner's information in the designated fields. This includes your first name, middle initial, last name, social security number, and date of birth. Ensure that you provide a complete mailing address, including any P.O. Box if applicable.

- Next, indicate whether this is an initial designation or a change of designation by checking the appropriate box. If it is a change, ensure to complete section 5 as well.

- Provide the names and information for primary beneficiaries. Include their names, relationships to you, addresses, social security numbers, and date of birth. You must designate how the shares will be allocated, ensuring that total shares equal 100%.

- Similarly, identify contingent beneficiaries in case none of the primary beneficiaries survive you. Repeat the necessary fields as done for primary beneficiaries.

- In the signature section, sign and date the form exactly as your name appears on the account. If there is a joint owner, they must also sign.

- If you are making a change of beneficiary designation, ensure to obtain a medallion signature guarantee from an authorized institution, as required in section 5.

- Finally, review all provided information for accuracy, then save your changes. You may download, print, or share the form as needed.

Complete your Tiaa Cref Beneficiary Designation Forms online today and secure your legacy.

Yes, you can typically put a beneficiary on your bank account online, depending on your bank's policies. Many banks offer an online process similar to Tiaa Cref Beneficiary Designation Forms, allowing you to add and manage beneficiaries conveniently. It's a simple way to ensure your bank account assets are directed as you intend.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.