Loading

Get 2012 Form 760es

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Form 760es online

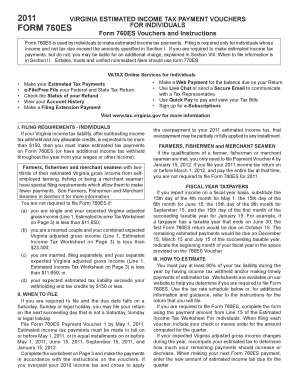

Navigating tax forms online can be a straightforward process with the right guidance. The Form 760es is designed for individuals making estimated income tax payments in Virginia, and this guide will walk you through the essential steps to complete it effectively.

Follow the steps to successfully complete the 2012 Form 760es.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Review the filing requirements outlined in Section I. Ensure that you are required to pay estimated taxes by confirming your expected Virginia adjusted gross income is above the specified thresholds.

- Fill out your personal information at the top of the form. This includes your Social Security number and contact details.

- Navigate to the Estimated Income Tax Worksheet included with the Form 760es. Use this worksheet to calculate your expected Virginia taxable income, taking into account deductions and credits.

- Complete the payment voucher section. Calculate the estimated income tax based on your worksheet results and determine the required payment amount.

- If applicable, indicate any overpayment credit from the previous tax year that you wish to apply to your estimated tax.

- Once the form is complete, review all entries for accuracy. Save the completed form to your device.

Get started by filing your Form 760es online today!

To obtain your annual tax statement online, you can visit the Virginia Department of Taxation's website and use their online services. You will need to provide your personal information for verification. Some third-party platforms, such as USLegalForms, can also assist you in accessing these documents efficiently. Utilizing these resources ensures you stay on top of your tax requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.