Get Charity Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Charity Application Form online

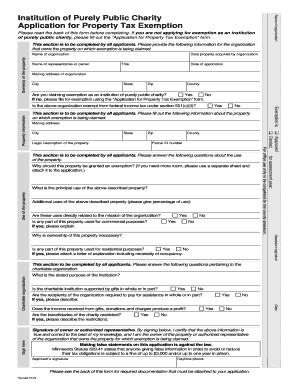

Filling out the Charity Application Form online is an essential step for organizations seeking property tax exemption as institutions of purely public charity. This guide will walk you through each section of the form to ensure a smooth application process.

Follow the steps to complete your Charity Application Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name of the organization that owns the property on which exemption is being claimed. Include the name of the representative or owner, the date the property was acquired, and the title of the representative.

- Provide the date of the application and the mailing address of the organization, including city, state, zip code, and county.

- Indicate whether you are claiming exemption as an institution of purely public charity by selecting 'Yes' or 'No.' If 'No,' follow the directions to fill out the alternative exemption form.

- Complete the property information section with details such as the mailing address and legal description of the property, including the parcel ID number and the primary use of the property.

- Detail any additional uses of the property, including the percentage related to each. Confirm if these uses are directly related to the mission of the organization.

- Answer whether any part of the property is used for commercial purposes and provide explanations if applicable.

- Explain why ownership of the property is necessary and state the reasons why the exemption should be granted. If more space is needed, attach a separate sheet.

- Complete the questions regarding the charitable organization’s exemption status, ensuring you provide accurate responses.

- Sign the application as the owner or authorized representative and provide your daytime phone number. Make sure to review all information for accuracy.

- Finally, save your changes. You can also download, print, or share the form as needed.

Ensure your organization’s eligibility for exemption by completing the Charity Application Form online today.

Starting a 501c3 requires a clear mission statement, bylaws, and a board of directors in place. You will also need to file IRS Form 1023 to apply for tax-exempt status. Furthermore, proper records of your organization’s activities and finances are essential for compliance. USLegalForms provides resources to assist you with each of these requirements effectively, helping you navigate the process seamlessly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.