Loading

Get R 1376

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R 1376 online

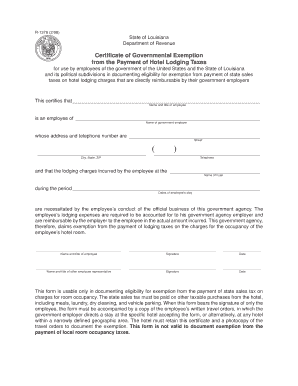

Filling out the R 1376 form is an essential process for documenting eligibility for governmental exemption from hotel lodging taxes. This guide will provide you with clear, step-by-step instructions to ensure that you accurately complete the form online.

Follow the steps to complete the R 1376 form online

- Click 'Get Form' button to obtain the form and open it in the editor.

- In the first section, provide the name and title of the employee who is claiming the exemption. Ensure this is spelled accurately, as it will be used for documentation purposes.

- Next, enter the name of the government employer in the designated field. This should reflect the full name of the organization that employs the individual named in the previous step.

- Fill out the address of the government employer. Include the street address, city, state, and ZIP code to ensure precise identification of the organization.

- Document the telephone number of the government employer. This provides a point of contact for any inquiries related to the exemption.

- In the section requesting the name of the hotel, enter the full name of the hotel where the lodging took place.

- Specify the dates of the employee’s stay at the hotel in the designated fields. This is important for establishing the period of lodging expenses incurred.

- The employee should then sign and date the form to certify the information provided. This confirms their authority and the legitimacy of the claims made.

- An additional representative from the government agency must also sign and date the form in the provided space to validate the request for exemption.

- Review the completed form for accuracy. Once confirmed, you may save the changes, download, print, or share the form as needed.

Complete the R 1376 form online today to ensure your lodging expenses are properly documented and eligible for tax exemption.

To fill out a CT sales and use tax resale certificate, start by providing your business name, address, and the seller's details. Clearly state the reason for resale and keep the form accurate to avoid any issues. Utilizing our services ensures you can complete this form correctly and efficiently, aligning with R 1376 compliance standards.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.