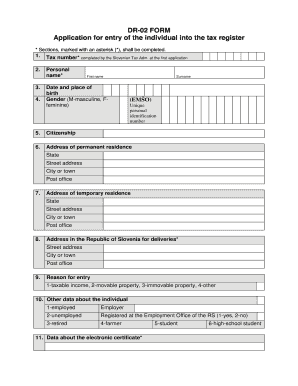

Get Dr-02 Form Application For Entry Of The Individual Into The ... - Durs - Durs Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DR-02 FORM Application For Entry Of The Individual Into The Tax Register online

Filling out the DR-02 FORM is essential for individuals looking to enter their information into the tax register. This guide provides a clear, step-by-step approach to assist users in thoroughly completing the application online, ensuring compliance with all necessary requirements.

Follow the steps to complete the application seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the tax number field. If you do not have a tax number assigned yet, leave this blank; the Slovenian Tax Administration will fill it during the first application.

- Enter your personal name and first name in the designated fields.

- Provide your date and place of birth, along with your gender, marking either 'M' for masculine or 'F' for feminine.

- Input your unique personal identification number (EMŠO) if available and state your citizenship.

- Fill in your address of permanent residence, including the state, street address, city or town, and postal information.

- If applicable, provide your address of temporary residence following the same format as above.

- Enter your address in the Republic of Slovenia for deliveries, if different from your permanent or temporary residence.

- Specify your reason for entry, selecting from options such as taxable income, movable property, immovable property, or other, relevant only if you lack permanent or temporary residence.

- Provide additional data about your employment status by selecting one of the options given and entering relevant details, such as employer name if employed.

- Indicate data about any electronic certificates you possess.

- List any persons authorized for representing you, including their tax number, name, and address. State the type of representative and limits of authorizations.

- Fill out information about any domestic capital investments, marking whether it is a registration, change, or deregistration.

- Report on any capital investments abroad using the same process as the previous step.

- Input data regarding accounts abroad including the account number in IBAN format, bank name, the state of the bank, and dates for account opening or closing.

- Provide information on any procedures for insolvency, marking the type, dates of final orders on initiation and closure, and methods of closure.

- Sign and date the application, ensuring all supporting documents are included before submission.

Complete your DR-02 FORM application online today to ensure your entry into the tax register.

To get a VAT number in Slovenia, you must register for VAT with the Financial Administration. This process often involves submitting an application along with necessary supporting documents. By using the DR-02 FORM Application For Entry Of The Individual Into The ... - DURS - Durs Gov, you can ensure your application is completed accurately and processed in a timely manner.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.