Loading

Get Ustla 53 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ustla 53 Form online

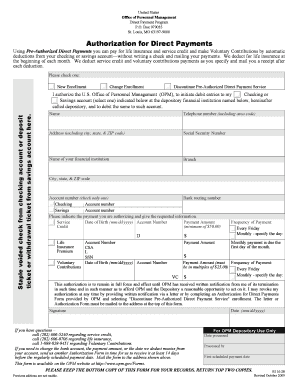

The Ustla 53 Form is essential for initiating pre-authorized direct payments for life insurance, service credit, and voluntary contributions. This guide provides step-by-step instructions for accurately completing the form online, ensuring a smooth submission process.

Follow the steps to complete the Ustla 53 Form online.

- Click ‘Get Form’ button to access the Ustla 53 Form and open it in the designated editor.

- Indicate your enrollment preference by selecting one of the following options: New Enrollment, Change Enrollment, or Discontinue Pre-Authorized Direct Payment Service.

- Attach a voided check from your checking account or a deposit or withdrawal ticket from your savings account in the specified area.

- Complete the authorization section by providing your name, telephone number, address, and social security number.

- Choose whether the payments will be deducted from your checking or savings account, then provide the name of your financial institution, branch information, and the corresponding account and bank routing numbers.

- Specify the payments you are authorizing, including selecting the type of service (life insurance or voluntary contributions) and providing the account numbers required.

- For each payment option selected, include necessary details such as the payment amount, frequency of payment (either Every Friday or Monthly), and any specified dates.

- Review the authorization terms, acknowledging that the authorization remains effective until written notification of termination is provided.

- Sign and date the form in the designated section, ensuring the date follows the mm/dd/yyyy format.

- Finalize the process by saving your changes, and if needed, download, print, or share the completed Ustla 53 Form as required.

Complete your Ustla 53 Form online today for streamlined direct payment management.

Selling your house is possible even if the IRS has a lien on your property, but it can complicate the process. The Ustla 53 Form is crucial in addressing tax liabilities that may arise during the sale. You will need to negotiate with the IRS to ensure that the lien is satisfied accordingly. Taking the right steps can lead to a smoother transaction while addressing your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.