Loading

Get Va 6

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Va 6 online

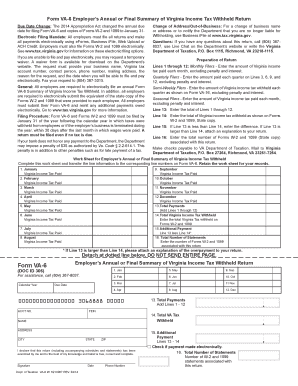

This guide provides comprehensive steps for completing the Va 6 form online, which is essential for employers to summarize Virginia income tax withheld. Following these instructions will help ensure accuracy and compliance with tax regulations.

Follow the steps to complete the Va 6 form online easily.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Identify your filing status: Monthly, Quarterly, or Semi-Weekly, as this will determine how you report the income tax withheld.

- For Monthly Filers, fill in the amount of Virginia income tax paid each month in lines 1 through 12, excluding penalty and interest.

- Quarterly Filers should enter the amounts paid each quarter on Lines 3, 6, 9, and 12, ensuring penalties and interest are not included.

- Semi-Weekly Filers must report the total Virginia income tax withheld each quarter as displayed on Form VA-16, also excluding penalties and interest.

- On Line 13, total the amounts reported on Lines 1 through 12.

- On Line 14, enter the total Virginia income tax withheld as reported on Forms W-2 and 1099.

- If Line 13 is less than Line 14, enter the difference on Line 15. If it is larger, attach an explanation of the overpayment with your return.

- Enter the total number of Forms W-2 and 1099 associated with this return on Line 16.

- Review the entire form for accuracy, and when complete, you can save changes, download, print, or share the form as needed.

Complete your Va 6 form online today to ensure timely and accurate filing.

To get VA into AMPS, you will need to integrate your Virginia tax information using the appropriate software. Setting up digital accounting software can simplify the process and ensure accuracy. By syncing your VA tax data, you can manage your financial information efficiently, ultimately minimizing errors. Utilize platforms like US Legal Forms for templates that assist with this integration.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.