Get Iowa Form 123

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iowa Form 123 online

This guide provides step-by-step instructions on how to complete the Iowa Form 123 online, ensuring that users understand each section and field effectively. Whether you have prior experience with tax forms or are navigating the process for the first time, this guide is designed to assist you in accurately filing your Net Operating Loss Worksheet.

Follow the steps to fill out the Iowa Form 123 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

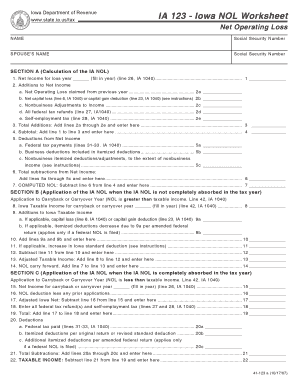

- Begin with Section A, which involves calculating your Net Operating Loss (NOL). Start by entering the year for which you are calculating the loss and fill in the net income from line 26 of your IA 1040. This amount will be the starting point for your calculation.

- Proceed to add any necessary additions to your net income. Complete fields 2a through 2e by filling in the corresponding amounts for any previous year's NOLs, capital losses or gains, federal tax refunds, and self-employment tax.

- Sum lines 2a through 2e and input the total on line 3. Then, add this to your net income (line 4) to determine your subtotal.

- Next, you will enter any deductions from your net income in Section A. Fill in lines 5a through 5c with federal tax payments and any business or nonbusiness deductions applicable.

- Calculate the total subtractions on line 6 by adding lines 5a through 5c. Subtract this total from the subtotal on line 4 to compute your Computed NOL, which you will enter on line 7.

- If your NOL is not fully absorbed in the tax year, continue to Section B. Fill in information about your Iowa taxable income for the carryback or carryover year on line 8.

- In Section B, detail any additions and adjustments necessary for lines 9a through 11. Gather all relevant amounts that apply to this year, ensuring to calculate adjusted tax income accordingly.

- Once you have computed your adjusted taxable income on line 13, proceed to line 14 for the NOL carryforward amount.

- If your NOL has been fully absorbed, switch to Section C. Perform any required calculations similar to those in Section B, ensuring each relevant field is filled accurately.

- After completing all sections, ensure that you have reviewed all your entries for accuracy before saving the document. You may now save changes, download, print, or share the filled form as necessary.

Start filling out the Iowa Form 123 online today!

To file an Iowa tax return, you typically need Iowa Form 123, which is designed for individual income tax filing. This form helps you report various income sources and apply applicable deductions. Depending on your specific situation, you may need additional schedules or forms as well. It's important to review the requirements carefully to ensure compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.