Loading

Get De9adj Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the De9adj Instructions online

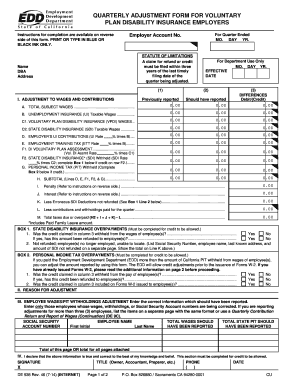

Completing the De9adj Instructions online can streamline the adjustments to your quarterly contributions. This guide will provide you with detailed steps to fill out the form accurately and efficiently, ensuring compliance with the required regulations.

Follow the steps to complete the De9adj Instructions online.

- Click the ‘Get Form’ button to obtain the De9adj Instructions form. This action will allow you to access the document in an online editing format.

- Fill in the employer account number and the quarter ended date. This information is crucial for identifying the period the adjustments will apply to.

- In the first section labeled ‘Adjustments to wages and contributions’, enter amounts in the columns for previously reported figures, correct amounts, and the differences, following the clear instructions provided.

- Complete penalty and interest details if applicable. Add any penalties owed for late adjustments and calculate the interest based on the total due.

- In the section for employee wages and PIT withholdings adjustments, accurately enter corrections for any discrepancies related to individual employees. Ensure that each entry includes the necessary details of wages and withholdings.

- Provide a brief reason for the adjustment if required. This will help clarify the context of the corrections you are submitting.

- Sign and date the form, including your contact information. This ensures that the Department can reach you for any follow-up questions regarding your submission.

- After completing the form, save your changes, and consider options to download or print the document for your records. Be sure to share it with appropriate parties if needed.

Take action now and complete the De9adj Instructions online for efficient document management.

The comparison between DE9 and DE9C often confuses employers. DE9 serves as a comprehensive report of wages and withholdings for a complete quarter, while DE9C is focused on amendments or corrections for the DE9. Understanding these distinctions is key to ensure accurate payroll reporting. If you need to amend a report, use the correct DE9C form for clarity and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.