Get Verification Of Deposit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

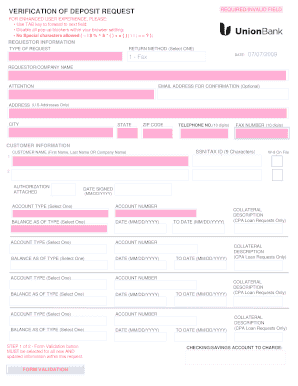

How to fill out the Verification Of Deposit Form online

Filling out the Verification Of Deposit Form online is a straightforward process that allows users to efficiently request necessary banking information. This guide provides you with clear instructions on how to complete each section to ensure your request is processed smoothly.

Follow the steps to successfully complete your online form.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin with the Requestor Information section. Here, fill in the TYPE OF REQUEST and select the RETURN METHOD that best suits your needs. Enter the DATE in the specified format.

- Provide your Requestor/Company Name, Attention (if necessary), and your email address for confirmation (optional). Include the address, city, state, ZIP code, and telephone number.

- Move to the Customer Information section. Enter the CUSTOMER NAME (either First Name and Last Name or Company Name) and the SSN/TAX ID. Ensure the SSN/TAX ID is entered without any dashes.

- Indicate whether AUTHORIZATION is ATTACHED and include the DATE SIGNED in the required format.

- Select the ACCOUNT TYPE and enter the ACCOUNT NUMBER. Next, provide the BALANCE AS OF and the corresponding DATE.

- Repeat the previous step for additional accounts if needed, selecting the proper ACCOUNT TYPE and documenting the BALANCE AS OF and DATE for each.

- If applicable, fill out the COLLATERAL DESCRIPTION for CPA Loan Requests, including the relevant dates.

- Complete the form by reviewing all entered information for accuracy. Ensure you select the FORM VALIDATION button for all new and updated information.

- After confirming that all information is accurate, save your changes. You can then decide to download, print, or share the form. Make sure to fax it with the cover sheet if required.

Get started on completing your Verification Of Deposit Form online to streamline your banking requests.

A verification of deposit is primarily used by banks and lenders to evaluate an individual’s financial health when applying for loans or mortgages. This document provides essential proof of funds, assuring lenders that applicants have the necessary assets to support their financial commitments. Additionally, it serves as a reliable way to facilitate other financial transactions, such as rental applications. By utilizing the verification of deposit form, you significantly enhance your credibility in financial dealings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.