Loading

Get Fillable Jordan Tax Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Jordan Tax Forms online

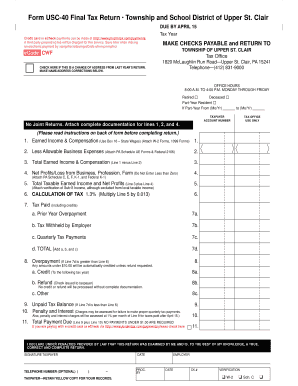

Filling out the Fillable Jordan Tax Forms online can seem daunting, but with the right guidance, you can complete the process smoothly and accurately. This guide offers a detailed explanation of each section of the form to help you navigate through it with confidence.

Follow the steps to successfully complete your tax forms online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Review the form carefully and check the box if your address has changed since last year’s return. Provide any necessary corrections to your name or address in the designated space.

- Enter your taxpayer account number if applicable. Ensure that the information matches what is on file.

- Complete the 'Earned Income & Compensation' section by entering your income as reported in Box 16 of your W-2 forms, along with any 1099 forms.

- If applicable, list any allowable business expenses on the next line, attaching necessary documentation such as PA Schedule UE Forms and Federal Form 2106.

- Calculate your total earned income and compensation by subtracting your allowable business expenses from your earned income.

- Record your net profits or loss from business activities. If this amount is negative, enter zero as the form requires not to enter less than zero.

- Total your taxable earned income and net profits in the following section.

- Calculate the tax by multiplying your total taxable income by the tax rate. Enter this figure as indicated.

- Document all payments you have made, including prior year overpayments, taxes withheld by your employer, and any quarterly tax payments.

- If your total payments exceed your calculated tax, detail the overpayment and decide on the credit option or request a refund.

- Complete the sections for unpaid tax balance, penalty, and interest if applicable.

- Sign and date the form to confirm that the information provided is true and complete.

- Once you have completed all sections, save your changes, download a copy of the form for your records, print it, or share it as necessary.

Start completing your tax forms online today for a smoother filing experience.

When filing your tax return, it is essential to include documents such as W-2 forms, 1099s, and any receipts for deductible expenses. Additionally, utilizing Fillable Jordan Tax Forms helps to ensure that you include all necessary forms, which can vary based on your financial situation. Having these documents ready will streamline the process and improve accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.