Loading

Get Form St A1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form St A1 online

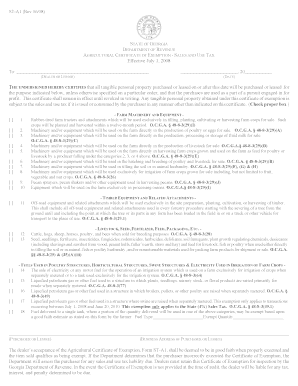

Filling out the Form St A1 online is an essential step for users seeking an agricultural certificate of exemption from sales and use tax in the state of Georgia. This guide provides a step-by-step approach to ensure that all fields are completed accurately and efficiently.

Follow the steps to fill out the Form St A1 with ease.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the name of the dealer or lessor in the designated field on the form.

- Specify the date in the appropriate format, ensuring accuracy in the day, month, and year.

- In the certification section, indicate the purpose for which the tangible personal property will be purchased or leased by checking the relevant box.

- Complete the fields related to the categories of exempted items, including farm machinery, livestock, seed, and fertilizers by selecting all that apply.

- Fill in the purchaser or lessee's information, making sure to include their business address clearly.

- Review all entered information carefully for accuracy and completeness.

- Once the form is fully completed, save your changes, and utilize the download or print options to obtain a hard copy for your records. You may choose to share the form electronically as needed.

Ready to get started? Complete your Form St A1 online today.

A 1A report typically refers to an informational document required by certain regulatory authorities, sometimes in connection with tax filings. It may include financial data or an outline of business activities. To ensure compliance, check with your local tax authority regarding the specifics of what needs to be reported and consider reviewing Form St A1 as part of your documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.