Loading

Get Efw2c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Efw2c online

Filing the Efw2c form electronically can streamline the process of correcting and reporting wage details. This guide provides step-by-step instructions to facilitate accurate completion of the Efw2c online.

Follow the steps to complete the Efw2c form efficiently.

- Click 'Get Form' button to obtain the Efw2c form and open it in the designated editor.

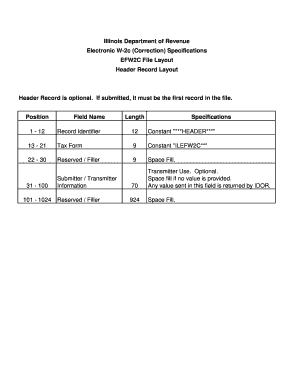

- Review the Header Record section. This is optional but, if included, must be the first record in your file. Input the Record Identifier with the constant value '***HEADER***', followed by the Tax Form identifier 'ILEFW2C**', and ensure that the Reserved / Filler space is filled appropriately.

- Complete the Submitter / Transmitter Information section. This section is optional and can be left blank if no value is provided. If input is provided, IDOR will return any submitted value.

- Proceed to the Submitter Record (RCA) layout, where you will enter the Record Identifier 'RCA' and include any necessary supplemental data.

- Fill out the Employer Record (RCE). Enter 'RCE' as the Record Identifier, followed by the required supplemental data.

- Complete the Employee Wage Record (RCW) section using 'RCW' as the Record Identifier, along with any additional data needed.

- Move to the State Wage Record (RCS) layout. Input 'RCS' as the Record Identifier and populate the necessary supplemental data.

- Fill out the Total Record (RCT) section with 'RCT' as the Record Identifier, providing the required supplemental information.

- Complete the Total Record (RCU) layout by entering 'RCU' as your Record Identifier and incorporating the supplemental data needed.

- Finalise the State Total Record (RCV) section with 'RCV' as the Record Identifier. Enter totals for employee records as instructed, ensuring accuracy and right justification.

- Conclude with the Final Record (RCF) layout, marking it with 'RCF' as the Record Identifier and any supplemental data required.

- Once you have filled out all sections of the form, ensure to save your changes, and prepare the document for download, printing, or sharing as required.

Begin your online Efw2c submission now to ensure accurate reporting and corrections.

The EFW2 format is a standardized way of reporting various financial details to the IRS, primarily related to wages and tax information. It includes key data points like employee information, employer details, and amounts withheld for taxes. By utilizing EFW2C, businesses ensure that their reporting is accurate and compliant with regulations. This makes tax filing simpler and more straightforward for all parties involved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.