Get Fss4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fss4 online

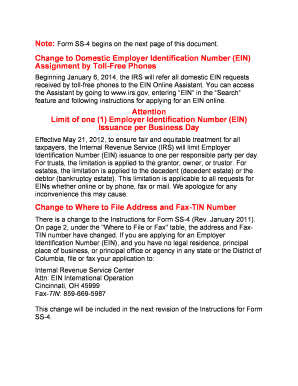

Filling out the Fss4, or Application for Employer Identification Number, can seem daunting but is necessary for various entities including businesses, trusts, and estates. This guide provides detailed instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the Fss4 online effectively.

- Press the ‘Get Form’ button to access the Fss4 and open it in your preferred editor.

- Enter the legal name of the entity or individual requesting the EIN in line 1. Make sure to provide the name exactly as it is registered or officially recognized.

- If the business has a trade name that differs from the legal name, input this on line 2.

- On line 3, include the executor, administrator, or trustee's name if applicable; otherwise, leave it blank.

- Provide the mailing address on line 4a and, if necessary, the street address on line 5a. Ensure that line 5a does not include a P.O. box if it is different from line 4a.

- Fill in the city, state, and ZIP code for both the mailing (lines 4b) and street addresses (lines 5b). Follow instructions for foreign addresses if needed.

- Identify the county and state where the principal business is located in line 6.

- Enter the name of the responsible party in line 7a and provide the Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or current EIN in line 7b.

- Indicate if the application is for a limited liability company (LLC) by checking 'Yes' or 'No' on line 8a.

- Select the appropriate type of entity in line 9. Ensure only one box is checked.

- On line 10, specify the reason for applying by checking one box. Additional information may be provided in the 'specify' area.

- Fill in the date business started or acquired on line 11 and indicate the closing month of the accounting year on line 12.

- Estimate the highest number of employees expected in the next 12 months on line 13. If none, enter '0'.

- If the employment tax liability is expected to be $1,000 or less in a full calendar year, check the appropriate box on line 14.

- Provide the first date that wages or annuities were paid on line 15.

- Select the principal activity of the business on line 17 and describe the principal line of merchandise or services on line 18.

- Indicate if the entity has previously applied for an EIN on line 19.

- Complete the third-party designee section if applicable, filling out details like name and phone number.

- Finally, review all entries for accuracy. Save changes, download, print, or share the completed form as necessary.

Complete the Fss4 online today to ensure your business is compliant with IRS requirements.

To obtain a 147C letter from the IRS online, start by accessing your account on the IRS website. If you do not have an account, you will need to set one up, which provides access to various IRS services. Alternatively, you may also call the IRS and request the letter directly; ensure you have your EIN available during the call. This process can save you time and provide you with crucial documentation for your business.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.