Get Form 2210 Penality

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2210 Penalty online

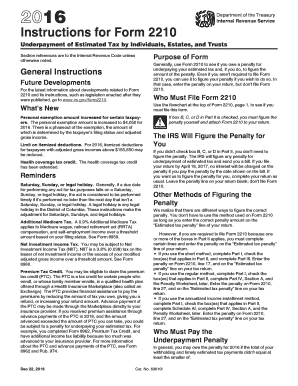

Filling out Form 2210 is essential for individuals, estates, and trusts that may owe a penalty for underpaying their estimated tax. This guide will provide clear and supportive instructions to help users complete this form online effectively.

Follow the steps to fill out Form 2210 Penalty online.

- Click ‘Get Form’ button to obtain the form and access it for editing.

- Begin with Part I—Required Annual Payment. Complete lines 1 through 9 to determine your required annual payment based on your tax situation. Accurately enter your withholding and estimated tax payments.

- In Part II, check the appropriate box(es) that apply to your circumstances. This helps determine if you must calculate the penalty yourself or if the IRS will do it for you.

- If using the short method, proceed to complete Part III. Calculate your total underpayment by following the directions for each line and section on the form.

- For the regular method, complete Part IV. Ensure you provide necessary information on required payments and use the Penalty Worksheet to determine the amount due.

- If applicable, utilize the annualized income installment method by filling out Schedule AI to adjust your required installments based on fluctuating income.

- Review all sections for accuracy. Once completed, you can save the changes, download, print, or share the filled-out Form 2210 online.

Start filling out your Form 2210 online today to ensure your estimated tax penalties are calculated correctly.

If you don't file Form 2210 when required, the IRS may automatically calculate your underpayment penalty based on your tax return information. This might lead to a higher penalty than if you had filed it yourself. Additionally, failure to file can result in potential interest charges on any unpaid taxes. The US Legal Forms platform can help ensure you file Form 2210 correctly and on time to avoid these issues.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.