Loading

Get Oregon Insurance Tax Return Instructions Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Oregon Insurance Tax Return Instructions Form online

Filling out the Oregon Insurance Tax Return Instructions Form can seem daunting, but with a comprehensive guide, you can navigate the process confidently. This guide provides clear, step-by-step instructions tailored to meet your needs as you complete this important online form.

Follow the steps to fill out the Oregon Insurance Tax Return Instructions Form online.

- Press the ‘Get Form’ button to access the Oregon Insurance Tax Return Instructions Form and open it in your chosen editor.

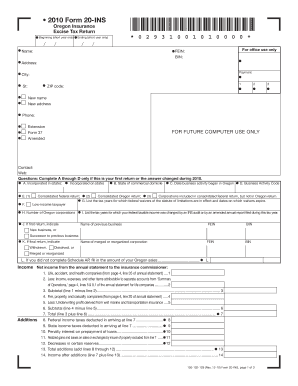

- Begin by entering the required corporation details, including the Federal Employer Identification Number (FEIN) and Oregon Business Identification Number (BIN), in the header section.

- Proceed to complete the income section by inputting net income from the annual statement, following the specific line instructions provided.

- Next, add any necessary additions to your income, such as federal income taxes or realized gains, as outlined in the instructions.

- Continue by applying any allowable subtractions from your income as indicated, including amortization and increases in certain reserves.

- Once your income has been adjusted, calculate your Oregon taxable income using the formulas provided.

- Determine your tax liability by following the tax calculation guidelines, ensuring you use the appropriate tax rate based on your taxable income.

- After calculating your taxes, fill in the credits and offsets section to reduce the total tax liability, referring to the list of available credits.

- Review all entries for accuracy and completeness before proceeding to save changes or prepare for submission.

- Finally, save your completed form, download, print, or share it as necessary, ensuring all payments or required attachments are included.

Complete your Oregon Insurance Tax Return online today to ensure timely and accurate filing.

You can find Oregon state tax forms on the Oregon Department of Revenue's official website. They provide a comprehensive list of forms required for various tax returns. Additionally, you can also visit uslegalforms, where you can access the Oregon Insurance Tax Return Instructions Form and other necessary documents to assist you in your tax preparation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.