Loading

Get Taking A Lump Sum From A Plan Already In Drawdown

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taking A Lump Sum From A Plan Already In Drawdown online

This guide provides comprehensive instructions for users on how to effectively fill out the Taking A Lump Sum From A Plan Already In Drawdown form online. It is designed to assist users in navigating the process with clarity and confidence.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the Taking A Lump Sum From A Plan Already In Drawdown form. Make sure to have the form open in your preferred online PDF editor for easy completion.

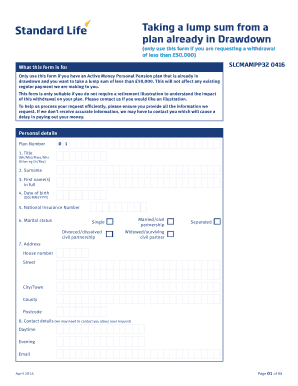

- Enter your personal details accurately. This includes your plan number, title (such as Mr, Mrs, Ms, or Dr), surname, first names, date of birth (in DD/MM/YYYY format), and National Insurance number.

- Indicate your marital status by selecting from the options provided: married/civil partnership, single, divorced/dissolved civil partnership, separated, or widowed/surviving civil partner.

- Provide your current address, including house number, street, city/town, county, and postcode.

- Fill out your contact details, including your daytime and evening phone numbers, as well as your email address. This information is necessary for communication regarding your request.

- Consider seeking guidance before proceeding. The section suggests using Pension Wise or obtaining financial advice to understand the implications of your decision.

- Specify the amount of lump sum you wish to withdraw. Enter the amount or choose to take the remainder of your plan. Note that this is before tax deductions.

- Complete the bank account details section, ensuring you are named on the account. Provide the bank/building society name, account number, sort code, and account name to receive your funds.

- Check the Lifetime Allowance conditions by answering the relevant questions about the combined value of your pensions and any registered protections.

- Review and confirm your declarations. This includes acknowledging the understanding of tax implications and that you have not significantly increased future contributions due to this lump sum.

- Sign and date the application at the bottom of the form. Ensure you include the current date in DD/MM/YYYY format.

- Post the completed form to the designated address provided at the end of the form. Ensure that you allow sufficient time for processing your request, which typically takes up to 10 working days.

Start filling out your documents online today to ensure a smooth withdrawal process.

Yes, you can typically withdraw a lump sum from your pension plan, depending on the rules set by your specific plan. It is essential to check the terms surrounding your plan to ensure you are eligible for this option. When considering taking a lump sum from a plan already in drawdown, always evaluate how this decision will impact your long-term financial security.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.