Loading

Get Business Trust

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Trust online

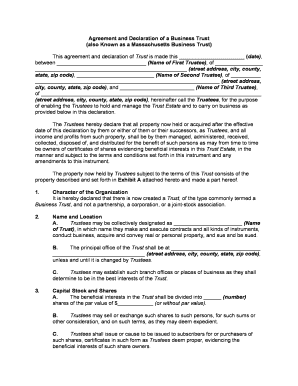

Filling out the Business Trust form online is an essential step in establishing your trust and conducting business effectively. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your Business Trust form online.

- Press the ‘Get Form’ button to access the Business Trust form and open it in your preferred editing tool.

- Begin by entering the date of the agreement in the designated space on the form.

- Provide the name and full address of the first Trustee in the corresponding sections.

- Continue with the second Trustee, filling in their name and full address as required.

- Repeat for the third Trustee, ensuring all information is accurate.

- In the section titled ‘Character of the Organization’, confirm that the type of organization is a Business Trust.

- Under ‘Name and Location’, specify the name of the Trust and the principal office address.

- Detail the capitalization structure by filling in the number of shares and their par value or indicate if shares have no par value.

- Describe the transferability of shares, ensuring compliance with the outlined conditions.

- Complete any additional sections as necessary, ensuring to include clauses about dividends, rights of shareholders, and liabilities.

- Review all entries for accuracy and completeness before finalizing.

- Once completed, save your changes, and choose to download, print, or share the form as needed.

Start completing your Business Trust form online today!

Placing your business in a Business Trust can enhance asset protection, streamline ownership transfer, and potentially provide tax benefits. This structure can create continuity, ensuring your business survives beyond your involvement. If you need assistance navigating this process, US Legal Forms offers resources to help you establish a Business Trust.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.