Get Form 1048

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1048 online

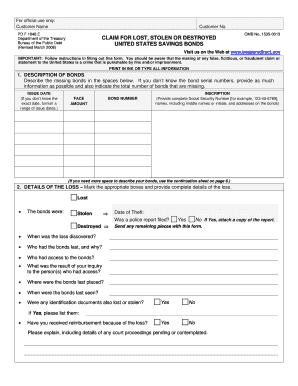

Form 1048 is used to claim relief for lost, stolen, or destroyed United States Savings Bonds. This guide provides a comprehensive and user-friendly walkthrough to assist you with filling out the form online, ensuring all necessary information is accurately captured.

Follow the steps to complete the Form 1048 online.

- Click ‘Get Form’ button to access the Form 1048 and open it in the editor.

- Begin by providing a description of the missing bonds in Section 1. Include all available details such as the issue date, face amount, bond number, and any inscriptions, ensuring to be as precise as possible even without serial numbers.

- In Section 2, indicate the details of how the bonds were lost, stolen, or destroyed. Mark the appropriate box, provide the date of theft if applicable, and answer questions regarding police reports and the circumstances surrounding the loss.

- Proceed to Section 3 and detail your authority to file the claim. Indicate whether you are named on the bonds, and if not, provide your relationship to the bond owner and any relevant legal designations.

- If a minor is included in the bond ownership, complete Section 4 with the minor's details and your relationship to them. Confirm their living situation and support status.

- In Section 5, specify whether you request substitute bonds or a payment option and provide the necessary details, including names for checks if applicable.

- In Section 6, fill out delivery instructions either for mailing bonds or for direct deposit using your bank account details.

- Finally, complete Section 7 by signing and certifying the form. Ensure that your signatures are witnessed by a certifying officer who will also provide their details.

- After completing the form, save your changes, download the document, and prepare it for submission according to the included mailing instructions.

Take action now and complete your Form 1048 online to claim your benefits.

To avoid paying taxes on inherited savings bonds, it is crucial to use Form 1048 correctly. Generally, you can transfer these bonds to a spouse or a qualified beneficiary, allowing you to potentially avoid tax liabilities. It's wise to consult a tax professional who can guide you through the specifics of inherited bonds and the best strategies. Understanding the tax implications will help you manage your finances more effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.