Get 2000 Form 1040

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2000 Form 1040 online

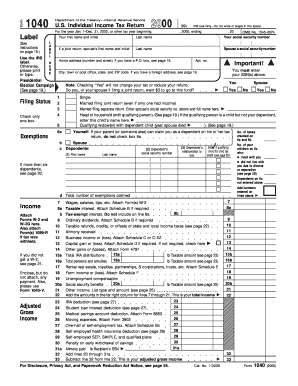

Filing your taxes can feel overwhelming, but completing the 2000 Form 1040 online simplifies the process. This guide will walk you through each section of the form clearly and concisely, ensuring that you have the information you need to complete your tax return successfully.

Follow the steps to fill out the 2000 Form 1040 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information. This includes your first name, last name, and social security number. Ensure that the information is accurate, as it is crucial for processing.

- Select your filing status by checking the appropriate box (e.g., single, married filing jointly, etc.). This determines your tax obligations and benefits.

- List your exemptions. Complete lines 6a through 6c by checking boxes for yourself, your spouse, and dependents. The total number of exemptions affects your tax calculations.

- Report your income by filling out lines 7 through 21. Attach Forms W-2 for your wages, and include any other income types such as business income or unemployment compensation.

- Calculate your adjusted gross income on line 33 by subtracting allowable deductions from your total income. Refer to the instructions to ensure accuracy.

- Proceed to the tax and credits section. Enter your itemized deductions or the standard deduction on line 36. Calculate your taxable income on line 39.

- Complete the total tax section on lines 40 through 52, including any credits you may qualify for.

- Determine your total payments on lines 58 through 64, reflecting any taxes withheld and estimated payments.

- If you are owed a refund, complete line 67 for direct deposit information. If you owe money, calculate the total amount due on line 69.

- Finally, sign and date the form at the bottom. Both partners must sign if filing jointly. Make sure to keep a copy for your records.

Complete your 2000 Form 1040 online today for a simpler filing experience.

Whether you need to file taxes with only $2000 of income depends on various factors, including your filing status and age. Generally, if your income is below the filing threshold, you may not need to submit a 2000 Form 1040. However, filing could still be beneficial, as it allows you to claim potential refunds or credits. If you're unsure, consulting with resources or services provided by platforms like US Legal Forms can offer clarity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.