Loading

Get Ghana Revenue Authority

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ghana Revenue Authority online

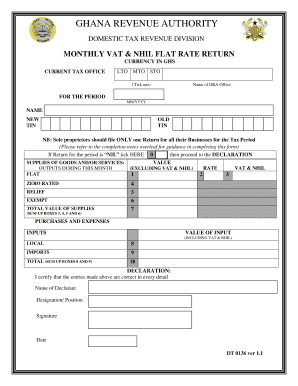

This guide provides clear instructions on how to complete the Ghana Revenue Authority's monthly VAT and NHIL flat rate return form online. By following these steps, users will be able to accurately file their returns and ensure compliance with tax regulations.

Follow the steps to complete your form successfully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Select your current tax office by ticking the appropriate box: LTO, MTO, or STO.

- Enter the period for which you are filing the return in the format MM/YYYY.

- Provide the legally registered name of your business or your name as a sole proprietor.

- Fill in your New TIN, which is an eleven-character number, and your Old TIN, which is a ten-character number.

- If your return for the period is 'NIL', tick the designated box and proceed to the declaration section.

- Input the values in the 'Supplies of Goods and/or Services' section by filling out boxes 1 through 6. Each box pertains to different categories of supplies and must be completed accurately.

- Fill out the 'Purchases and Expenses' section, ensuring that boxes 8 and 9 are filled appropriately, reflecting the values of local and imported purchases.

- Calculate the total by summing the values in boxes 8 and 9 to complete box 10.

- In the declaration section, ensure it is signed by the appropriate person based on your business structure (sole proprietor, partnership, or corporation).

- Review all entries for accuracy before saving your changes, downloading, printing, or sharing the form.

Complete your documents online today to ensure timely and accurate compliance with tax regulations.

As a beginner, start by gathering all necessary documents, such as income statements and proof of expenses. Familiarize yourself with the guidelines provided by the Ghana Revenue Authority to understand your obligations. For extra help, consider using platforms like uslegalforms, which offer a step-by-step approach to simplify the tax filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.