Loading

Get 01 117

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 01 117 online

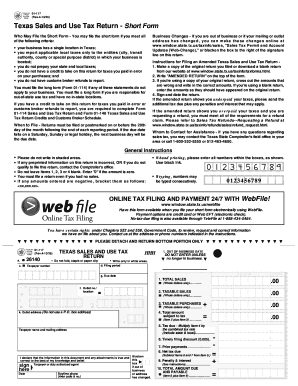

Filling out the Texas Sales and Use Tax Return - Short Form (01 117) online can streamline the process of reporting your business's tax information. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to access the 01 117 online document and open it in the editor.

- Enter your taxpayer number in Item c. This is the number shown on your sales tax permit. If you do not have a permit, enter your Social Security number if you are a sole owner or the Federal Employer Identification Number (FEIN) for other organizations.

- Fill out Item d with the filing period for your report, indicating whether it's for a month, quarter, or year, and include the last day of the period.

- Indicate in Item l if the business is out of operation, providing the out-of-business date.

- In Item 1, report the total sales amount without tax, entering '0' if there are no sales to report.

- For Item 2, enter the total amount of taxable sales. Again, report '0' if there are no taxable sales.

- In Item 3, state the total of taxable purchases you made for your own use, entering '0' if applicable.

- Add the amounts from Item 2 and Item 3 to fill out Item 4. If no amounts are applicable, enter '0'.

- Calculate the tax due in Item 5 by multiplying the total in Item 4 by the combined tax rate, then enter this total.

- If applicable, calculate the timely filing discount in Item 6 and include any prior payments in Item 7.

- Complete the calculation for net tax due in Item 8 by subtracting Items 6 and 7 from Item 5.

- If there is a penalty or interest, include that in Item 9.

- Sum Items 8 and 9 to get the total amount due in Item 10.

- Review your form for accuracy and save your changes. You can then download, print, or share the completed form as needed.

Take the next step and complete your forms online for efficient tax reporting.

No, the Texas sales and use tax permit number is not the same as an Employer Identification Number (EIN). The permit number specifically pertains to sales tax collection and reporting, while the EIN is used for federal tax purposes. It’s important to keep both numbers handy as you manage your business obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.