Get Canada Sc Isp-1300 E 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada SC ISP-1300 E online

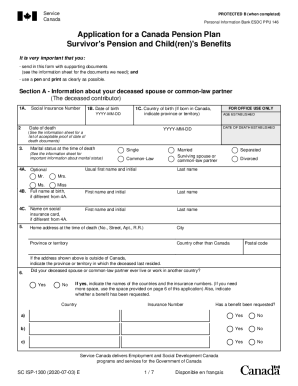

This guide provides a straightforward approach to completing the Canada SC ISP-1300 E form online, ensuring clarity and ease of understanding for all users. Filling out this application correctly is crucial for securing survivor's benefits and child(ren)’s benefits under the Canada Pension Plan.

Follow the steps to complete the online application successfully.

- Press the 'Get Form' button to access the Canada SC ISP-1300 E and open it in your chosen online editor.

- Begin with Section A, which requires information about the deceased spouse or common-law partner. Fill in their social insurance number, date of birth, country of birth, date of death, and marital status at the time of death.

- Next, provide home address details of the deceased in Section A, including their street address, city, province or territory, and postal code.

- Indicate whether the deceased ever lived or worked in another country. If so, list the countries and provide relevant insurance numbers.

- Proceed to Section B, where you will provide your own information as the surviving spouse or common-law partner. Include your social insurance number, date of birth, and preferred languages for communication.

- Complete your mailing address and provide the contact numbers as required. Also, answer questions regarding previous benefit applications.

- Once all sections are completed, save your changes. You can now download, print, or share the form as needed.

Take the next step in securing your benefits by completing the Canada SC ISP-1300 E form online today.

Claiming your Canadian pension while living in the US is straightforward, but it does require attention to detail. You’ll need to submit the appropriate forms and verify your eligibility through your local Canada Pension Plan office. The Canada SC ISP-1300 E can guide you through necessary steps and paperwork. To enhance your experience, consider using uslegalforms for simplified documentation and instructions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.