Loading

Get Form 67

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 67 online

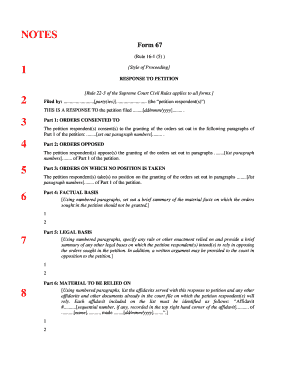

Filling out the Form 67 online can seem daunting, but with the right guidance, it becomes a manageable task. This guide will walk you through each section of the form, ensuring you understand what is required for a successful submission.

Follow the steps to successfully complete Form 67 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the style of proceeding at the top of the document. This includes the court number and the names of the parties involved, written in capital letters.

- In the 'Filed by' section, indicate the name of the party or parties who are responding to the petition.

- Review Part 1, and list the orders from the petition that you consent to, noting the relevant paragraph numbers.

- In Part 2, specify any orders from the petition that you oppose by listing the associated paragraph numbers.

- Fill in Part 3 with orders you take no position on, clearly stating your intent to abide by the court's decision.

- For Part 4, provide a factual basis for your argument by summarizing key material facts that support your position on the petition.

- In Part 5, outline the legal basis for your response. Include references to any relevant rules, laws, or precedents.

- Complete Part 6 by listing any affidavits and documents you rely upon, identifying them with their respective numbers and dates.

- Estimate the time required for the application in the designated section.

- Sign the form by including your name or the name of the lawyer representing the petition respondent.

- Provide a physical address for service in the final section, along with any additional contact methods you wish to include.

- Once you have completed all sections, ensure all information is accurate. Save the changes, and you can download, print, or share the form as needed.

Start filling out your Form 67 online today to streamline your legal processes.

A DD Form 67 is a document used by military personnel for specific administrative purposes. While it serves a different function, it's important not to confuse it with Form 67, which is for tax credits. Understanding the distinctions between forms ensures accurate filing. If you have multiple forms to manage, USLegalForms can help organize your filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.