Loading

Get 913 469 4029 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 913 469 4029 Form online

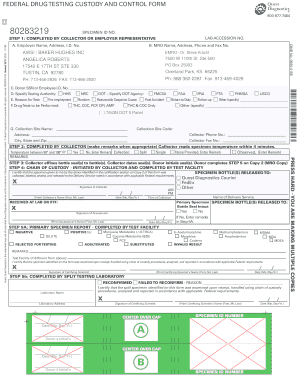

Filling out the 913 469 4029 Form online is a critical process for ensuring proper drug testing and custody procedures. This guide will walk you through each section of the form with clear instructions to make the experience user-friendly and comprehensive.

Follow the steps to complete the 913 469 4029 Form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the required sections of the 913 469 4029 Form.

- Enter the employer's name, address, and ID number in Section A. This information is essential for identifying the organization responsible for the drug test.

- In Section B, input the Medical Review Officer's (MRO's) name, contact information, and address accurately. This ensures proper communication for any necessary follow-up regarding the test results.

- For Section C, provide the donor's Social Security Number or Employee ID Number to link the test to the correct individual.

- Indicate the testing authority and the reason for the test in Sections D and E. Specify the circumstances surrounding the testing, such as pre-employment or random testing.

- In Section F, select the types of drug tests to be performed. Options may include various substances; ensure you choose according to the relevant testing requirements.

- Complete the collection site information, including the collector's phone number, address, and other identifying details in Section G.

- Follow the prompts to complete steps 2 through 5 on the form, ensuring that all required fields are filled in accurately and any necessary remarks are included.

- At the final step, after completing all sections of the 913 469 4029 Form, remember to save any changes you made. You can download, print, or share the form as needed.

Take action now by filling out your forms online for a streamlined process.

A 4506 form is primarily used to request a copy of your tax return from the IRS. This can be essential for various purposes, such as applying for a mortgage or verifying income for financial aid. Understanding its uses can help ensure you have your tax documents when needed. The 913 469 4029 Form details the context in which this form is most beneficial.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.