Get Ndw R

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ndw R online

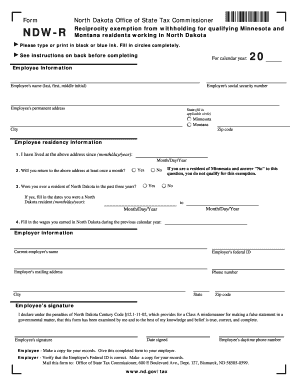

This guide provides a comprehensive overview of how to fill out the Ndw R form online. Designed for Minnesota and Montana residents working in North Dakota, this form allows you to request an exemption from North Dakota income tax withholding.

Follow the steps to complete the Ndw R form effectively.

- Press the ‘Get Form’ button to obtain the Ndw R form and open it in the editor.

- Carefully fill in your personal details, including your name, social security number, and permanent address. Ensure you select the correct state of residency by filling in the applicable circle for Minnesota or Montana.

- Provide your residency information. Indicate the date you have been residing at the provided address and confirm if you return to that address at least once a month.

- If you have previously lived in North Dakota within the last three years, specify the relevant dates. Additionally, enter the wages you earned in North Dakota during the previous calendar year.

- Fill in your current employer’s information, including the employer's name, federal ID, mailing address, and phone number.

- Sign and date the form to confirm that all information is accurate to the best of your knowledge. While providing your daytime phone number is optional, it can help in case of any follow-up questions.

- Review your information thoroughly to ensure every section is completed. Missing information may prevent the exemption from withholding.

- Once you have filled out the form, save your changes. You may then download, print, or share the completed document as needed.

Complete your Ndw R form online today to ensure proper tax withholding for your work in North Dakota.

The timeframe to receive a North Dakota state tax refund typically ranges from 10 to 12 weeks if filed electronically and up to 14 weeks for paper returns. However, processing times can vary based on various factors. Ndw R encourages timely and accurate submissions to expedite the refund process, guiding you throughout your tax journey. Knowing what to expect can alleviate some of the anxiety around refunds.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.