Loading

Get Tax Directive

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Directive online

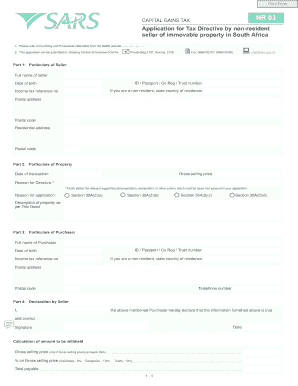

The Tax Directive is an important form for non-resident sellers of immovable property in South Africa. This guide provides clear and detailed instructions on how to complete the form online, ensuring that you navigate each section effectively.

Follow the steps to complete the Tax Directive online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part 1, enter your particulars as the seller. Include your full name, identification or passport number, date of birth, country of residence if you are a non-resident, income tax reference number, postal address, and residential address.

- In Part 2, provide the particulars of the property. Specify the date of the transaction, gross selling price, and reason for the directive. Ensure you attach any relevant supporting documentation needed for your application. Select one of the sections for your reason for application.

- Complete Part 3 with the particulars of the purchaser. Provide the full name, identification or passport number, date of birth, country of residence if non-resident, income tax reference number, postal address, postal code, and telephone number.

- In Part 4, fill in your declaration as the seller. State your name, acknowledge the correctness of the information provided, date the form, and provide your signature.

- At the end of the form, calculate the amount to be withheld based on the gross selling price if it exceeds R2 million. Indicate the applicable percentage based on your status (individuals, companies, or trusts) and total payable amount.

- Once all fields are completed, review the form for accuracy. You can then save your changes, download a copy, print it out, or share it as needed.

Start completing your Tax Directive online today!

Related links form

Yes, filling out a tax declaration form is important, especially when required by local tax authorities. This form helps you formally declare your income and can impact your filing obligations. Following any given tax directive will clarify if you need to submit this form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.