Loading

Get Formulaire 5000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulaire 5000 online

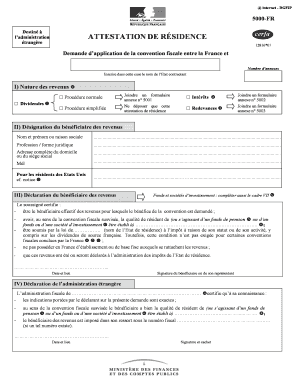

The Formulaire 5000 is a crucial document for individuals seeking to apply for tax treaty benefits between France and another state. This guide will assist you in accurately completing the form online, ensuring all necessary information is provided.

Follow the steps to fill out the Formulaire 5000 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editing tool.

- In section I, indicate the nature of the income by selecting one of the options: dividends, interest, or royalties. Ensure to also check the appropriate procedure type, either normal or simplified, and attach the relevant annex form if required.

- Section II focuses on the designation of the income beneficiary. Enter the full name or business name, profession or legal form, and the complete address including email. If the beneficiary is a resident of the United States, please refer to the specific notes provided.

- In section III, the income beneficiary must certify their status as the effective beneficiary of the income. They should also confirm residency status and taxation in their home state, along with declaring the income to the tax authorities.

- Section IV requires certification from the foreign administration, affirming the accuracy of the statements made by the applicant and confirming residency for tax purposes.

- In section V, the paying establishment must provide their name, address, and SIREN number, certifying the payment made to the beneficiary for the relevant tax year, detailing any taxes withheld.

- Section VI applies only to beneficiaries residing in the United States, where the financial institution confirms the beneficiary's status and the accuracy of the information submitted.

- Section VII, if applicable, involves providing details regarding investment companies or funds. This includes the financial year's dates and authorization numbers if relevant.

- Lastly, in section VIII, enter where any direct reimbursement should be sent, providing required banking information such as IBAN and SWIFT codes.

- Once all sections have been completed, save your changes, and prepare to download, print, or share the form as needed.

Complete your documentation efficiently online to ensure a smooth application process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, there is a tax treaty between the United States and France designed to prevent double taxation on income. This treaty helps individuals determine their tax liabilities and streamline the process of filing taxes in either country. When filing your taxes, including the Formulaire 5000, you can take advantage of provisions in the treaty to reduce your tax burden.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.