Loading

Get Ii Fllable Tax Form G 49

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ii Fllable Tax Form G 49 online

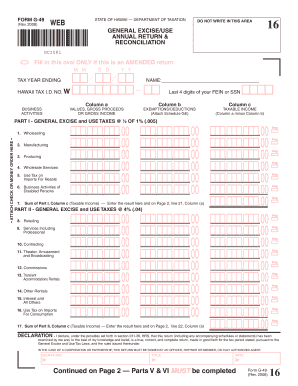

Filling out the Ii Fllable Tax Form G 49 online is a straightforward process that allows users to manage and file their general excise and use tax returns efficiently. This guide provides step-by-step instructions to help you complete the form accurately.

Follow the steps to complete the Ii Fllable Tax Form G 49 online.

- Press the ‘Get Form’ button to acquire the form and open it for editing.

- Input your Hawaii Tax I.D. number in the designated field. Ensure that this number is accurate, as it is essential for processing your return.

- Fill in your name in the provided space. This should be the name of the individual or entity filing the return.

- Indicate the tax year you are filing for by entering the date in the format MM/DD/YYYY.

- Move to Part I and list your gross income values, business activities, or gross proceeds in Column A. Record any exemptions or deductions in Column B.

- Calculate the taxable income by subtracting column B from column A for each entry and write the result in Column C.

- Continue to Part II to report additional taxable activities, following the same process as in Part I for columns A, B, and C.

- Proceed to Part III and fill in any insurance commissions if applicable, calculating the taxable income in the same way.

- Complete Part IV to report any Oahu Surcharge Tax, following the previous format.

- Fill out Part V by selecting the appropriate taxation district and entering your taxable amounts.

- In Part VI, summarize the total taxes due and complete the calculations for lines 21 through 34, ensuring you follow the tax rates provided.

- Finalize your form by signing, dating, and entering your title if you are filing on behalf of an organization.

- Once completed, save your changes, and you can download, print, or share the form as needed.

Start filling out the Ii Fllable Tax Form G 49 online today to ensure your compliance with tax regulations.

Essential documents for your tax return include W-2 forms, 1099 forms, and any receipts for deductible expenses. It's crucial to maintain accurate records to support your claims. The Ii Fllable Tax Form G 49 may require additional documentation depending on your income sources, so be prepared with all necessary paperwork.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.