Get Form Aep 5(a) (rev. 4). Standard Authority Allowing Customs Clearance Agents To Request Deferment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form AEP 5(a) (Rev. 4). Standard Authority Allowing Customs Clearance Agents To Request Deferment online

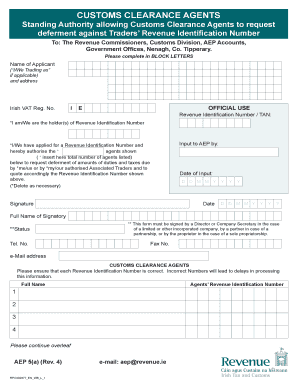

Filling out the Form AEP 5(a) (Rev. 4) is an essential step for customs clearance agents seeking authorization to request deferment against a trader's revenue identification number. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in your browser.

- In the first section, fill in the name of the applicant, including 'I/We Trading as' if applicable. Ensure you provide your complete address.

- Enter your Irish VAT registration number in the designated field.

- In the official use section, input the revenue identification number or Tax Account Number (TAN) you hold. Make sure this information is accurate to avoid processing delays.

- Indicate the total number of agents authorized to request deferment by inserting the appropriate number in the provided space.

- Sign and date the form, ensuring it is signed by an appropriate individual: a director or company secretary for limited companies, a partner for partnerships, or the proprietor for sole proprietorships.

- In the 'Full Name of Signatory' section, print the full name of the individual who signed the form.

- Provide the telephone number, fax number, and email address of the signatory for any further correspondence.

- List the names and revenue identification numbers of the agents in the subsequent sections, ensuring that all details are correct.

- After filling out the entire form, review all information carefully to confirm accuracy, and save your changes.

- Once verified, download, print, or share the completed form as needed for your records.

Complete your documents online today to streamline your customs processes.

A DAN number, or Deferment Account Number, is specific to customs declarations and allows customs clearance agents to defer payment of duties and taxes. This number is crucial for managing import duties seamlessly and ensures a quick clearance process. Utilizing resources like the Form AEP 5(a) (Rev. 4). Standard Authority Allowing Customs Clearance Agents To Request Deferment can further streamline any customs processes you may face.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.