Loading

Get Iht419

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht419 online

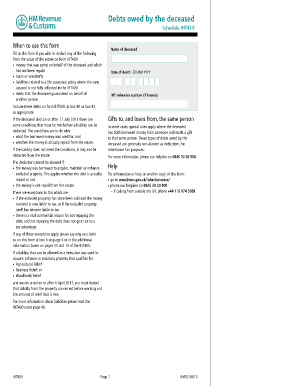

The Iht419 form is essential for claiming deductions for debts owed by a deceased person from their estate. This guide provides a clear, step-by-step approach to accurately completing the form online.

Follow the steps to successfully complete your Iht419 form.

- Click 'Get Form' button to obtain the form and access it in your preferred format.

- Enter the name of the deceased in the designated field. This identifies the individual whose debts you are reporting.

- Fill in the date of death in the correct format (DD MM YYYY). This date is crucial for determining relevant deductions.

- If you have an IHT reference number, input it in the provided field. This helps in processing the form.

- Answer questions regarding money spent on behalf of the deceased. If applicable, detail the relationship to the deceased, the purpose of the expenses, and reasons for non-repayment.

- Provide information about any outstanding loans or liabilities. Include the lender's name, relationship to the deceased, date of the loan, and the amounts involved.

- If applicable, indicate any liabilities related to life assurance policies. Include details like the insurance company and amounts owed.

- Document any debts guaranteed by the deceased on behalf of others. Supply necessary evidence if this applies.

- Answer the question about gifts and loans made to the same person. Provide dates and descriptions regarding gifts and loans as required.

- In the final section, provide any additional information that may aid in processing your application, with specifics on how the money was utilized.

- Once all sections are completed, ensure you review the information for accuracy. Save your changes, and you have the option to download, print, or share the form.

Complete your Iht419 online to ensure accurate reporting of debts owed by the deceased.

To fill income and expenditure, begin listing all income sources, followed by your monthly expenses. Categorize each item clearly to maintain order and clarity. This organized approach can greatly benefit your Iht419 submission. Accurate reporting ensures you have a strong financial document.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.