Get Form 13551

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13551 online

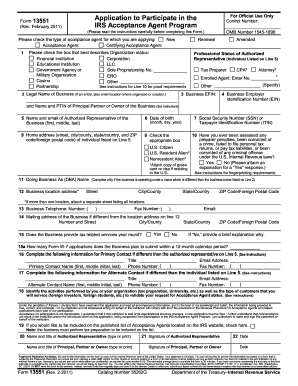

This guide provides an expert analysis and step-by-step instructions on completing Form 13551, the application to participate in the IRS Acceptance Agent Program. Whether you are applying for the first time or renewing your status, this resource is designed to help you navigate the process easily.

Follow the steps to complete Form 13551 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate whether you are a new applicant or renewing your application by checking the appropriate box regarding your status.

- Select the type of acceptance agent you are applying for, either Acceptance Agent or Certifying Acceptance Agent.

- Provide your legal name and the principal details for your business, including the location where it is organized.

- Enter your Business EFIN (Electronic Filing Identification Number) if applicable.

- Fill in your Business Employer Identification Number (EIN) and provide the name and PTIN (Preparer Tax Identification Number) of the principal partner or owner.

- List the name and email of the authorized representative along with their date of birth.

- Complete the home address for the authorized representative including street, city/county, state/country, and ZIP code/foreign postal code.

- Check the appropriate box to identify the legal status of the authorized representative in the U.S. (U.S. Citizen, U.S. Resident Alien, or Nonresident Alien).

- Answer the suitability question regarding any past penalties or convictions and provide explanations where necessary.

- If applicable, complete the Doing Business As (DBA) name field if your business operates under a different name.

- Enter the business location address and ensure it does not solely consist of a P.O. Box.

- Fill in the business telephone number, fax number, and email address.

- If your mailing address differs from your location address, provide the mailing address details.

- Indicate whether your business provides tax-related services year-round and offer a brief explanation if applicable.

- Complete information about primary and alternate contacts if they differ from the authorized representative.

- Attach supporting documents such as the fingerprint card or proof of professional status, if required.

- Review the form for accuracy, ensuring all required fields are completed.

- Sign and date the application where indicated by both the authorized representative and the principal partner or owner.

- Save changes, download, print, or share the form as needed before submitting it to the IRS.

Start filling out your Form 13551 online today to participate in the IRS Acceptance Agent Program.

To file a revocation of election, you typically need to submit Form 13551 to indicate your intention to revoke prior elections related to your tax status. Be sure to follow the specific guidelines outlined by the IRS to avoid any misunderstandings. Completing the revocation properly ensures that your election status reflects your current intentions. If you need a clear path through this process, uslegalforms can provide valuable templates to assist you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.