Get Il St 556 1 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Il St 556 1 Instructions online

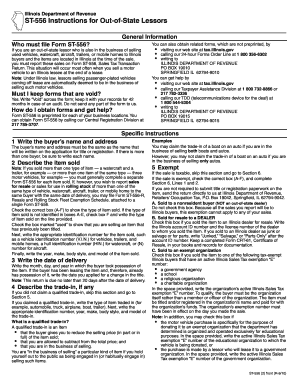

Filling out the Il St 556 1 Instructions is essential for out-of-state lessors engaged in selling used vehicles and other items to Illinois buyers. This guide will provide you with clear, step-by-step instructions to help you navigate the process online with confidence.

Follow the steps to complete the Il St 556 1 Instructions

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Write the buyer's name and address, ensuring it matches the details on the title or registration application. If there are multiple buyers, include each name.

- Describe the item sold by checking the appropriate box for the type of item and provide its identification number (e.g., VIN, HIN). Specify that the item is 'used' and include its year, make, body style, and model.

- Write the date of delivery, indicating when the buyer took possession of the item. If the buyer already has possession due to a lease, write the date of the title change application.

- If applicable, describe any trade-in by writing the type, identification number, year, make, body style, and model of the traded-in item.

- If the sale is exempt, check the relevant box in Section 5. If not, proceed to Section 6.

- Write the total sale price, rounding to the nearest dollar, and include any applicable costs. If a trade-in occurred, note the value in Section 4.

- Calculate the tax by subtracting any trade-in credit from the total price, determining the buyer’s tax rate, and applying it.

- Complete Lines related to county, city, and township as required, then finalize your calculations for any tax owed.

- Sign the return, ensuring it includes the seller's and all buyers' signatures. This validates that the traded-in item has been properly assigned.

- Save changes, and either download, print, or share the completed form as necessary.

Make sure you complete your Il St 556 1 Instructions online today to stay compliant with Illinois tax regulations.

To manage sales tax effectively, start by determining where your business is making sales and the applicable rates. Next, collect the appropriate sales tax from customers and keep detailed records of all transactions. Finally, refer to the IL St 556 1 Instructions to learn how to file your sales tax returns and remit payments to the state correctly. Utilizing resources like UsLegalForms can simplify this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.