Get T2201

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T2201 online

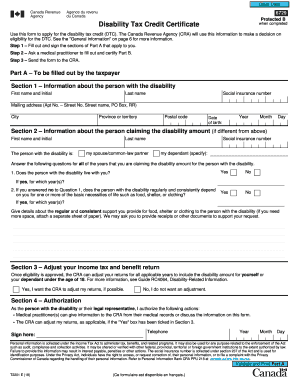

The T2201, known as the Disability Tax Credit Certificate, is a vital form for individuals seeking access to the Disability Tax Credit (DTC) in Canada. This guide will help you navigate the online process of completing this important document, ensuring you provide all necessary information for eligibility.

Follow the steps to complete the T2201 online.

- Press the ‘Get Form’ button to acquire the T2201 form and access it in an online editor.

- Fill out Part A, which includes your personal details such as your full name, social insurance number, and mailing address. Indicate your date of birth and any information about the individual claiming the disability amount, if it differs from yourself.

- Complete the eligibility questions regarding living arrangements and dependencies of the person with the disability, specifying which years the claims apply to.

- In Section 3, indicate whether you would like the Canada Revenue Agency (CRA) to adjust your income tax returns to include the disability amount for the applicable years.

- Sign and date the authorization section, which allows your medical practitioner to provide information to the CRA and grants permission for the CRA to adjust your returns if needed.

- After completing Part A, save the changes you made. Ensure that all information is accurate and complete before moving forward.

- Submit the form to your medical practitioner, who will complete and certify Part B. They will need to fill out specific sections based on the individual’s disabilities.

- Once Part B is completed, collect all parts of the form, review for any errors, and then send the entire T2201 form to the CRA as instructed.

Start completing your T2201 form online today to access the benefits you may be eligible for.

Related links form

To apply for a new Canada disability benefit, start by gathering necessary documents and identifying the type of benefit suitable for your situation. You will need to fill out the application forms, ensuring your T2201 form is included to verify your disability status. Once submitted, be prepared for further information requests to clarify your eligibility, making the process smoother.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.