Loading

Get Au Su580 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU SU580 online

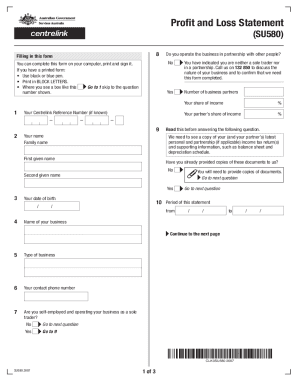

The AU SU580 is a vital form for sole traders and partners in a partnership to report business activities and income changes. This guide will provide you with straightforward, step-by-step instructions to complete this form online with confidence.

Follow the steps to successfully complete your AU SU580 form online.

- Click the ‘Get Form’ button to access the AU SU580 document in the online editor.

- Enter your Centrelink Reference Number, if known, to help process your application efficiently.

- Provide your full name in the designated fields, including your family name and given names.

- Indicate whether you operate your business in partnership with others by selecting 'Yes' or 'No.' If 'Yes,' specify the number of business partners and their share of income.

- Fill in the period of the statement by entering the start and end dates.

- List your business details, including the name of the business and type of business.

- Enter your contact phone number for any follow-up inquiries.

- Detail your gross business income for the specified period using the appropriate section.

- Complete the non-variable and variable expenses sections, providing necessary details for each type of expense.

- Calculate the total expenses and net income based on your inputs.

- Check the checklist to ensure you include any required supporting documents such as income tax returns.

- Read the privacy notice to understand how your information will be used.

- Sign the declaration affirming that the information provided is accurate and complete.

- Finally, return the completed form and any supporting documents either online through your account or in person at a service center.

Complete your AU SU580 and submit your documents online today for prompt processing.

Yes, you can create your own profit and loss statement using templates or accounting software. Ensure you include all relevant income and expense details for accuracy. For those adhering to AU SU580 requirements, using a structured approach is key to crafting a useful financial document.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.