Loading

Get Ifta/irp Application - Azdot

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IFTA/IRP Application - Azdot online

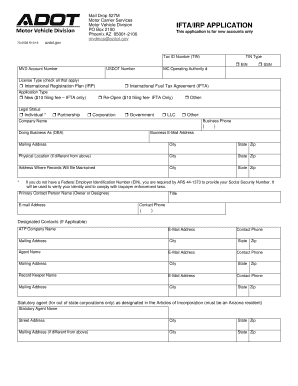

The IFTA/IRP Application is essential for individuals seeking to establish new accounts for the International Fuel Tax Agreement (IFTA) or the International Registration Plan (IRP). This guide provides clear, step-by-step instructions to help you navigate the online application process effectively.

Follow the steps to complete your application online.

- Click ‘Get Form’ button to begin the application process and access the form in an editable format.

- Fill in the Tax ID Number (TIN) and select the appropriate TIN type, either by checking the box for EIN or SSN. If applicable, provide your MVD Account Number and USDOT Number.

- Select the license types that apply to you by checking the boxes for International Registration Plan (IRP) and/or International Fuel Tax Agreement (IFTA).

- Indicate your application type by selecting either 'New' or 'Re-Open' if you are renewing. Note that there is a $10 filing fee for IFTA applications.

- Provide details about your legal status by selecting the appropriate option, such as Individual, Partnership, or Corporation.

- Complete the Company Name field, Business Phone, Business E-Mail Address, Mailing Address, and Physical Location if they differ.

- Designate a Primary Contact Person and input their contact details, such as name, title, and phone number.

- If applicable, add information for designated contacts, including ATP Company Name and contact details.

- List the names and titles of applicants (Owner, Partner, Officer, or Director) and their residence addresses. Attach additional listings if necessary.

- Answer the series of yes/no questions regarding past IFTA/IRP registrations, business names, or bankruptcy filings as applicable.

- IF you are applying under IRP, indicate your base jurisdiction and IRP Account Number from the preceding year. For IFTA applicants, provide the number of qualified vehicles and fuel types.

- In the jurisdiction section, check all areas where you will be traveling and operating bulk fuel storage facilities.

- Confirm agreement to comply with the provisions of IFTA and/or IRP. Sign and date where indicated; multiple signatures are required for partnerships.

- Once all fields are completed, review your application for accuracy. You may then save changes, download a copy, print, or share the form as needed.

Complete your IFTA/IRP Application online today to ensure a smooth and efficient application process.

The easiest way to track IFTA is to maintain detailed records of your fuel purchases and mileage. Consider using a specialized software or the user-friendly features of platforms like uslegalforms to simplify record-keeping. This method not only streamlines your reporting process but also enhances the accuracy of your IFTA/IRP Application - Azdot.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.