Loading

Get Irs Form 14234 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 14234 online

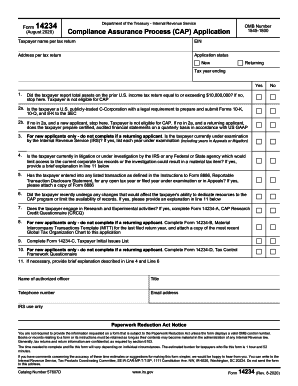

Filling out the IRS Form 14234 online can seem daunting at first, but with the right guidance, the process becomes much more manageable. This form is crucial for taxpayers participating in the Compliance Assurance Process, ensuring that you provide all necessary information in a clear and accurate manner.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your taxpayer name as it appears on your tax return in the designated field.

- Next, input your Employer Identification Number (EIN) accurately.

- Provide the address used on your tax return in the specified section.

- Select whether your application status is 'New' or 'Returning' by checking the appropriate box.

- For tax year ending, indicate 'Yes' or 'No' to confirm whether you reported total assets equal to or exceeding $10,000,000 on your prior tax return.

- Respond to question 2a by specifying whether you are a U.S. publicly-traded C-Corporation required to submit Forms 10-K, 10-Q, and 8-K to the SEC.

- If applicable, provide a list of years under examination by the IRS in question 3.

- Answer questions regarding litigation or investigations in question 4 and provide explanations where needed.

- Complete question 5 if you have been involved in any listed transactions by attaching Form 8886.

- Provide explanations for any significant changes affecting your resources or records in question 6.

- If applicable, address question 7 regarding Research and Experimental activities, completing Form 14234-A if necessary.

- Ensure that you complete Form 14234-C, which pertains to your initial issues list.

- If you are a new applicant, complete Form 14234-B and join any necessary attachments.

- Review all sections for accuracy and completeness before submitting your application.

- Save your changes, download a copy for your records, and print or share the completed form as needed.

Complete your IRS Form 14234 online today for a streamlined process.

The fastest way to verify your identity with the IRS is to use their online tool called ‘IRS Identity Verification Service’. This method provides immediate feedback upon submission of your information, reducing your waiting time. Engaging with IRS Form 14234 can further clarify the verification requirements necessary for this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.