Get Irs Instructions 2290 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions 2290 online

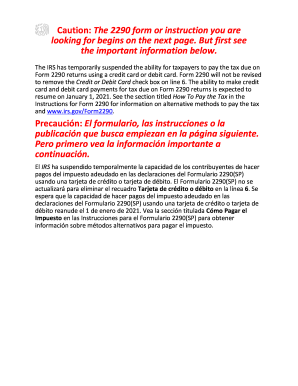

Filling out the IRS Instructions 2290 online can be a straightforward process when you have the right guidance. This guide provides clear, step-by-step instructions on how to correctly complete the form, ensuring that all necessary information is provided for effective tax management.

Follow the steps to fill out the IRS Instructions 2290 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer identification number (EIN) in the appropriate field. Ensure that this is accurate as it's required for filing.

- Input the vehicle identification number (VIN) for each vehicle that will be reported. This number can typically be found on the vehicle's title or registration.

- Fill in the taxable gross weight of each vehicle. This helps determine the appropriate tax category for your filings.

- Provide your name and address. Double-check for accuracy, as this information needs to match your previous filings.

- In Part I, figure the tax due based on the information entered in previous steps. Complete each section accurately to avoid delays.

- If applicable, complete Schedule 1 to report all vehicles, indicating any that are suspended from tax.

- Review all entered information for accuracy. Make any necessary corrections before proceeding.

- Once satisfied with the entries, save your changes. You can proceed to download, print, or share the completed form as needed.

Complete your IRS Instructions 2290 online today to ensure timely and accurate tax filing.

Get form

The IRS Instructions 2290 serve to inform taxpayers about the Heavy Vehicle Use Tax responsibilities. This tax helps fund the federal highway system, promoting safe and efficient transportation across the nation. By following these instructions, vehicle owners can accurately calculate their tax liability and ensure timely submissions. Platforms like US Legal Forms provide resources that simplify this process for users, enabling them to understand and comply with IRS guidelines effortlessly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.