Loading

Get Instructions For Form 941 (rev. July 2020) - Internal Revenue ...

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the instructions for Form 941 (Rev. July 2020) online

Filling out the Instructions for Form 941 can seem daunting, but with a clear step-by-step guide, you can navigate the process with ease. This guide will provide you with comprehensive instructions tailored for your needs.

Follow the steps to complete the instructions for Form 941 easily.

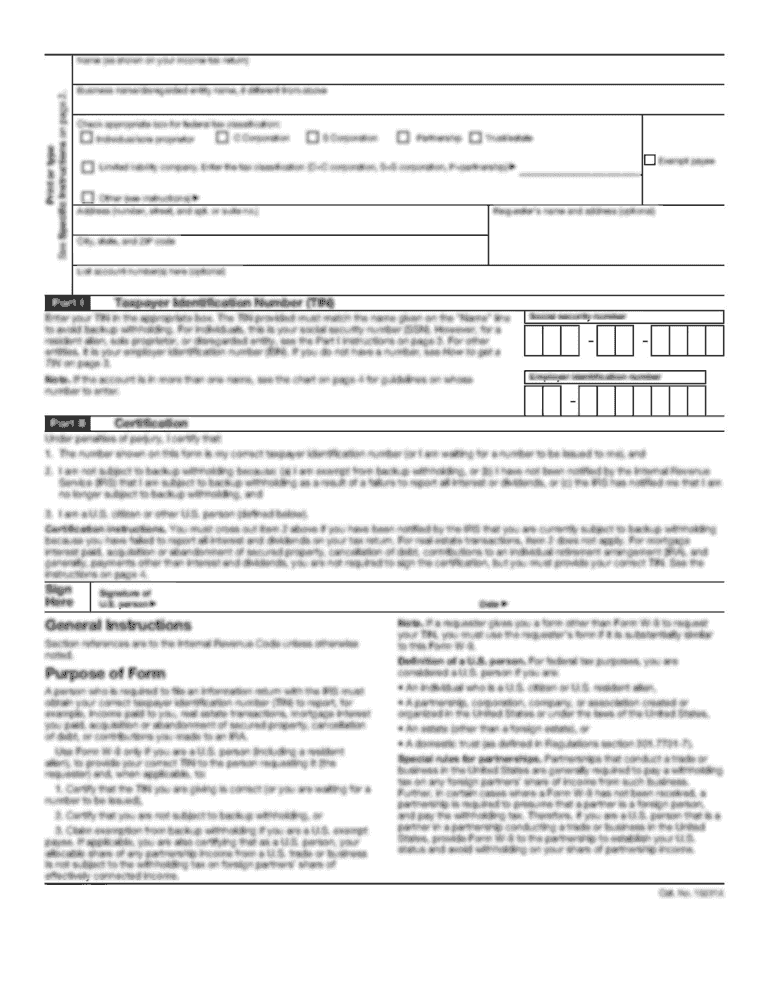

- Press the ‘Get Form’ button to access and open the form.

- Complete the basic information section, including your Employer Identification Number (EIN), name, and address. Ensure to use the legal business name as registered with the IRS.

- Indicate the quarter for which you are filing by checking the appropriate box on the top of Form 941.

- Enter the number of employees who received wages, tips, or other compensation during the specified pay periods.

- Fill in the taxable social security wages and Medicare wages. Be sure to include all relevant amounts without rounding them.

- Calculate adjustments for any uncollected employee share of taxes, as detailed in the instructions.

- Enter any credits available to you such as the credit for qualified sick leave or family leave wages.

- Review all entries for accuracy and completeness to ensure they reflect the correct amounts based on your payroll records.

- Sign and date the form on the last page, ensuring that you are authorized to submit the form on behalf of your business.

- Submit the form electronically or by mailing it to the appropriate IRS address, as instructed in the filing section.

- After completing the process, save your changes, download a copy of the filled form, print it for your records, or share it as needed.

Ready to complete your documents? Start filing online now!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Schedule B for 2020 follows the same general structure but includes updated guidelines in the Instructions For Form 941 (Rev. July 2020) - Internal Revenue. It encapsulates any changes made to tax laws or reporting requirements since the previous years, focusing on capturing monthly tax liabilities accurately. This schedule is an essential tool for employers aiming to stay compliant and avoid penalties.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.